For the first time since Dec 20th, The Dow dared to lose investors’ money for two days straight.

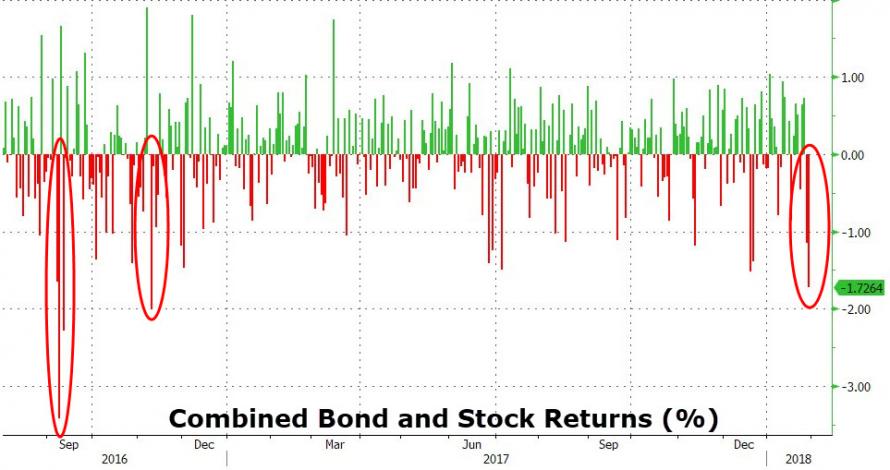

This is the biggest two-day drop since September 2016.

The culprits…?

Video length: 00:00:29

Bear in mind that stocks are still on the path to their best monthly gain in 2 years (and the 15th monthly gain in a row).

The Dow kicked off Tues regular trading session with a gap down that amounted to 241 pts, or 0.91 pct loss on the open. As a percentage of prior day’s close, that’s the worst opening gap since Sept 11, 2002, when the blue-chip average started with a 0.96 pct loss (Thomson Reuters data).

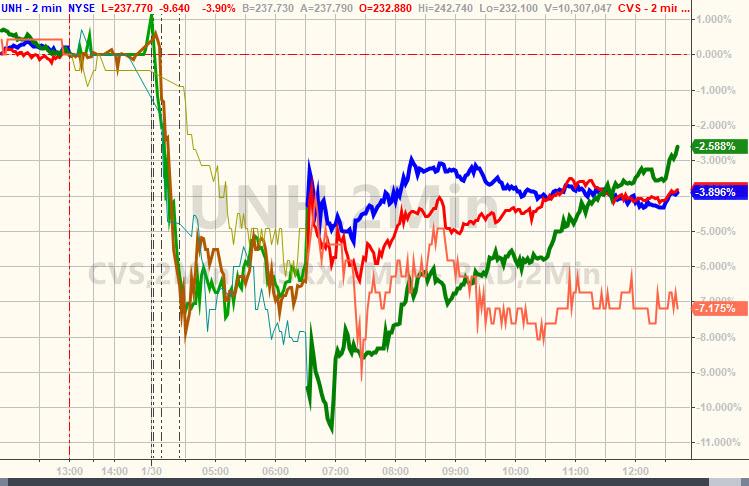

That said, today’s sharp Dow opening slide skewed by one stock, UnitedHealth; UNH responsible for ~100 pts of DJI opening drop, roughly 40% of the decline. The S&P 500 gap-opened today 0.73% lower – the worst initial print since May 17 of last year.

Friday’s meltup seems like a long time ago now…

China was ugly overnight again…

Healthcare-related stocks tumbled…

VIX spiked back above 15…

For the first time since August…

It wasn’t just Equity risk that is spiking…

And Credit markets started to stir with HY CDX back above 300bps…

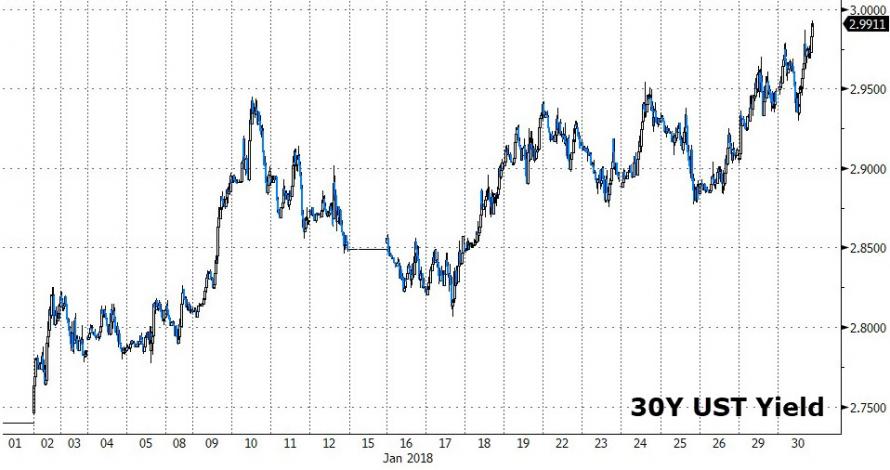

Bonds bloodbath even more with 10Y at new cycle highs and 30Y ramping up near 3.00%…

30Y up 26bps year-to-date…

Testing key technical levels…

Today was the worst day for bond and equity holders since the Election…

Which along with a spike in vol has crushed Risk Parity fund performance in the last couple of days…

Leave A Comment