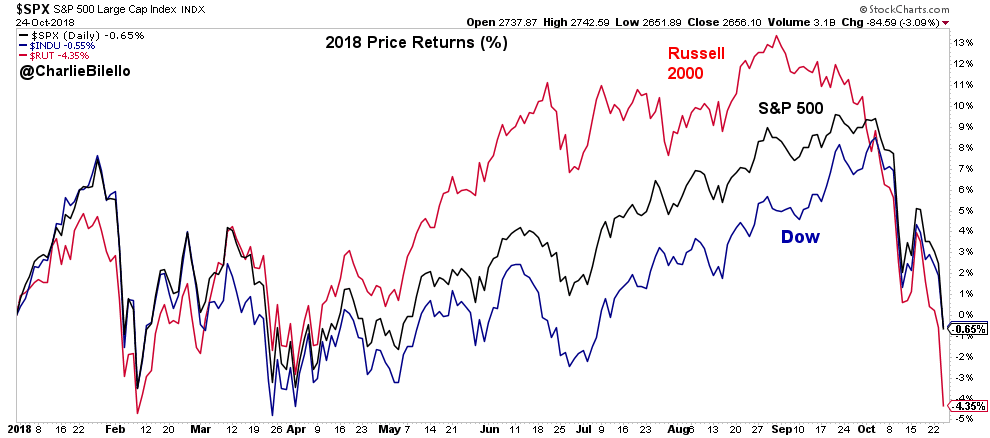

Fear is in the air again. Over the past few weeks, the S&P 500, Dow, and Russell 2000 have given back all of their gains on the year.

Note: Index price returns, does not include dividends.

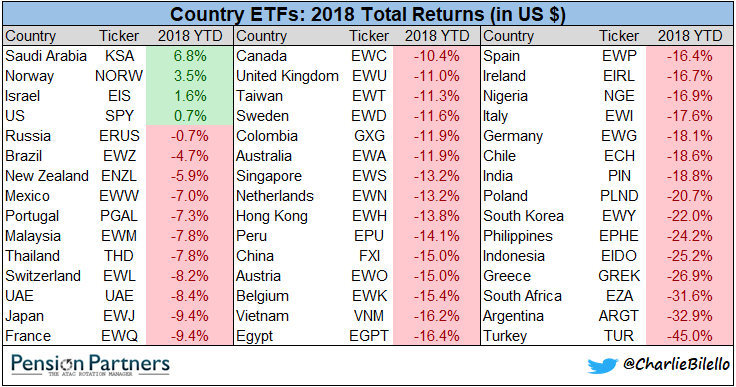

Meanwhile, international indices have fared much worse, with the average country ETF down 14% year-to-date.

Note: Total return, in U.S. Dollars, as of 10/24/18. Data Source for all tables herein: YCharts.

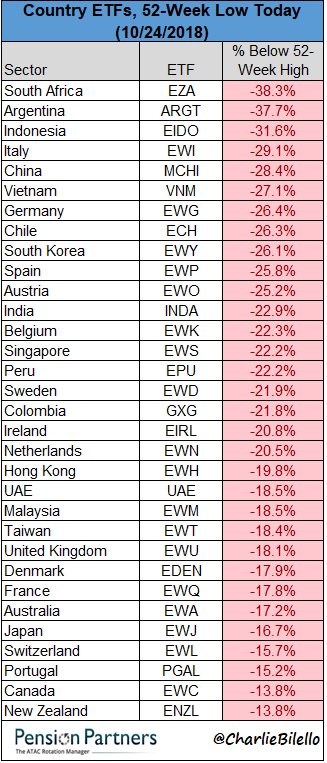

The list of countries hitting 52-week lows is a mile long…

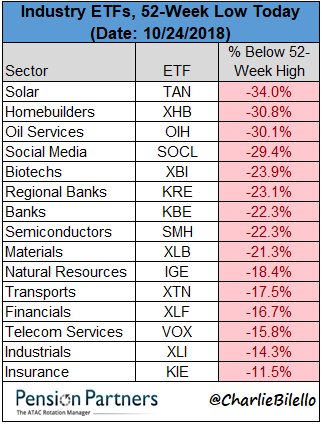

And a number of key sectors are hitting their lowest levels in over a year…

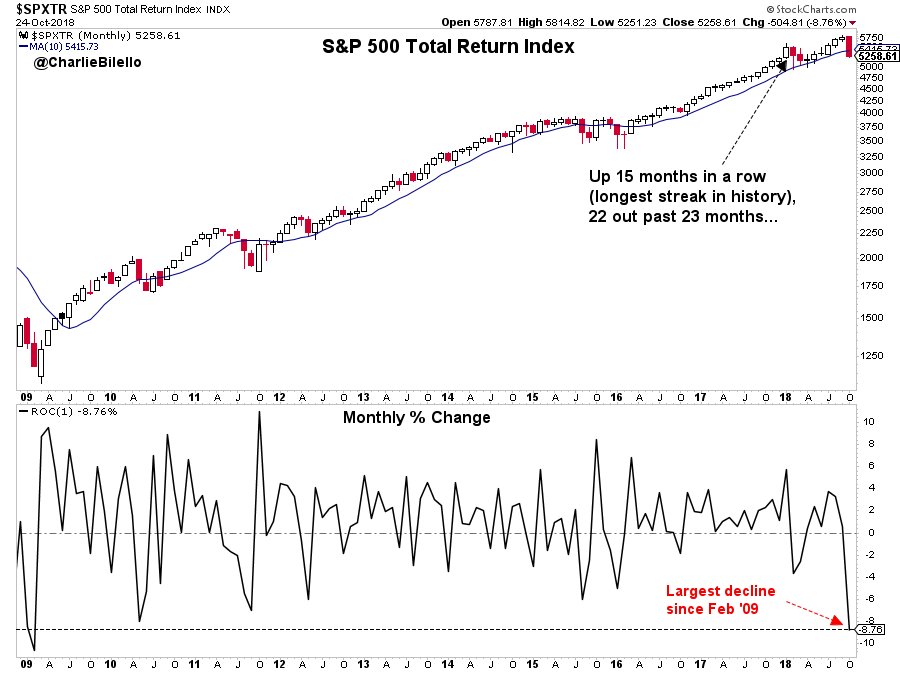

If the month ended today, it would be the worst for the S&P 500 since February 2009…

Unsurprisingly, financial media has taken notice. For the second time in two weeks, CNBC has aired an after-hours special report…

By popular demand.

?@CNBC? pic.twitter.com/LHM3b7DFwr

— Carl Quintanilla (@carlquintanilla) October 24, 2018

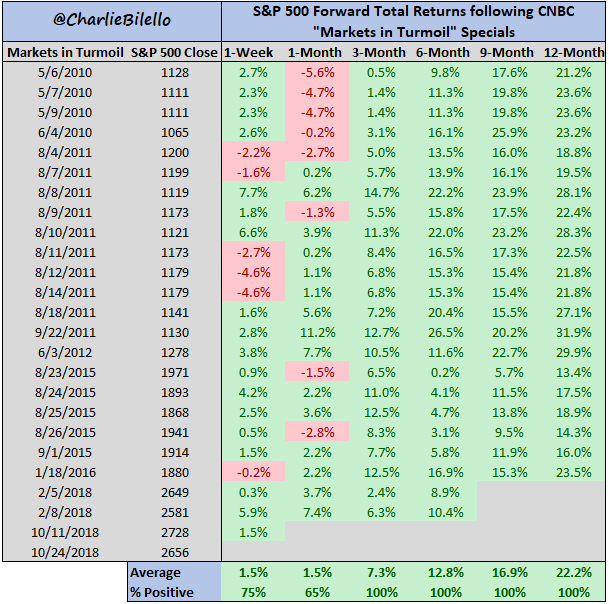

Historically, such reports have have served as a bullish contrarian indicator, with above-average S&P forward returns and gains 100% of the time looking out over the next 3-12 months.

Now, before you get too excited, there’s an important caveat that must be noted.

The dataset of “Markets in Turmoil” reports starts in 2010, and is, therefore, is limited to a bull market run where corrections have been short-lived. When next real bear market hits, there will surely be losses following these specials.

That said, as a short-term sentiment gauge, it’s been a pretty good one. And as a trader playing a bounce, I would much rather see a “markets in turmoil” special than regular programming.

For longer-term investors, the upside of downside is clear: it’s an opportunity to add money or reinvest dividends at lower prices/valuations and higher prospective returns. All long-term investors still in the adding/reinvesting phase should be rooting for a bear market today, and many more “markets in turmoil” specials in the years to come. Bring it on.

Leave A Comment