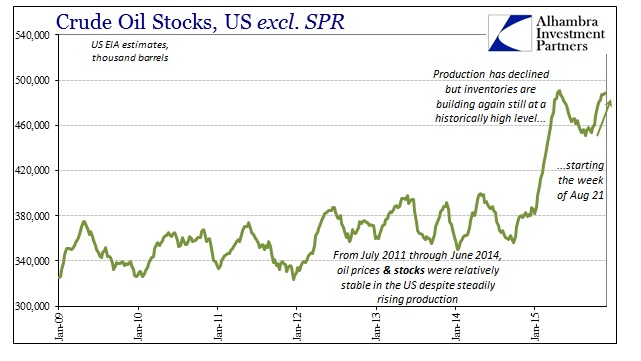

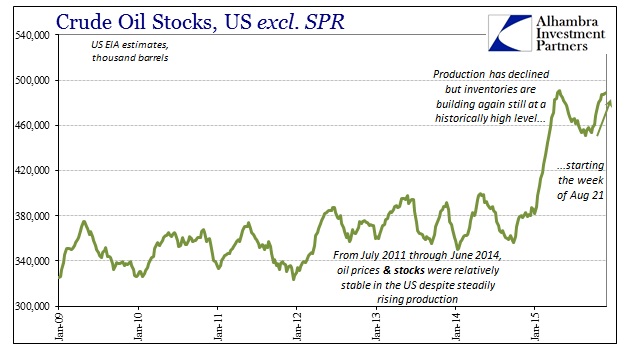

For the tenth straight week, dating back to the week just before the global liquidations in August, reported domestic crude inventories increased. At 489.4 million barrels, the current level of oil stock (excluding the SPR) is only slightly less than the record high of 490.9 million barrels reached the week of April 24. “Transitory” is dead.

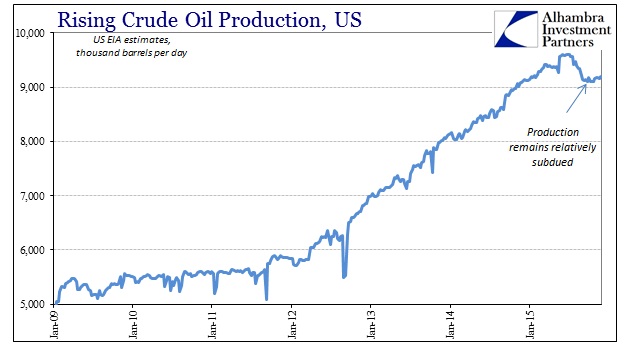

The increase in oil inventories comes again even as domestic production stalls at a significantly lower level than back in April. The only answer is, again, demand, as an astounding 35.5 million additional barrels have found themselves in storage just in those ten weeks since the heaviest breach of the latest “dollar” run.

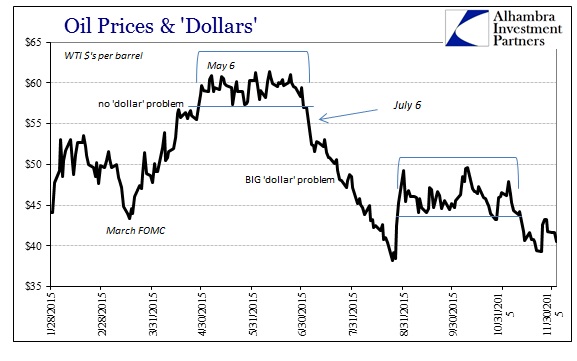

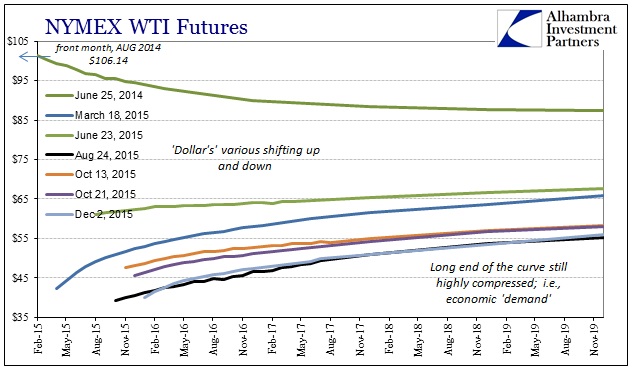

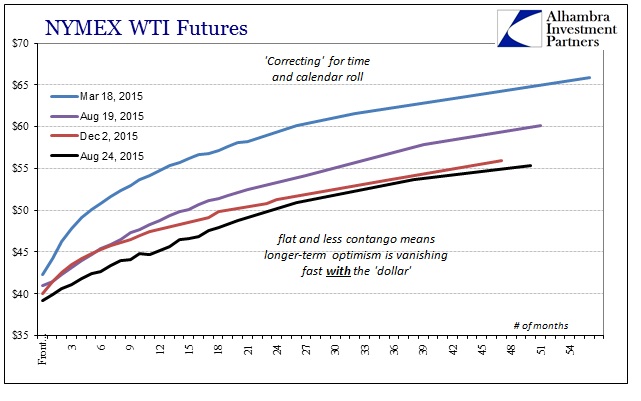

Given those continuing depressive dynamics, crude prices again flirt with $30, with the January 2016 futures trading as low as $39.84 today. Just as in that August turmoil, the crude/WTI futures curve is quite as flat and bearish now even though outwardly commentary and convention (which includes FOMC positioning) seems quite assured to have moved on.

These prices look nothing like the economic and financial conditions that demand the FOMC end ZIRP (not that ZIRP would do anything positive to begin with) lest this and the global economy overheat. Monetary practitioners are always finding themselves worried about being “behind the curve” in terms of inflation, and thus they only grow impatient and more so after each deliberative delay. What we see here is that there is no such curve for the FOMC to be behind, as nothing they suggest is even remotely priced on any front.

That includes, of course, the direct relation between these commodities, particularly crude, and crude eurodollar financialism that has performed the anti-ZIRP activities in 2015. After obliging FOMC rhetoric in late October, the eurodollar futures curve continues to renew its bearish flattening. Some attention is paid to the policy threat, but overall the curve suggests once more the opposite of what excites mainstream economic concerns (at least those expressed in public).

Leave A Comment