At the 9th Annual J.P. Morgan Homebuilding & Building Products Conference on May 17, 2016, Meritage Homes (MTH) released good news on guidance for the second quarter and fiscal year 2016. MTH expects notable year-over-year gains for FY2016 across all its top metrics except home closing gross margins:

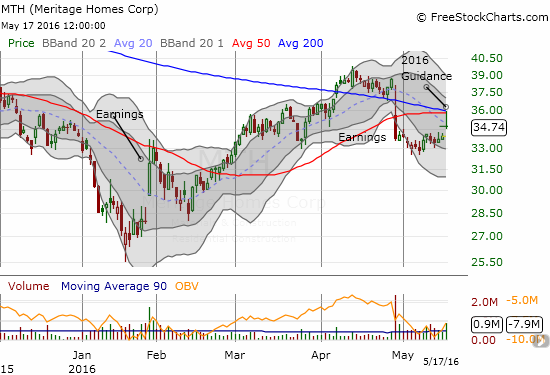

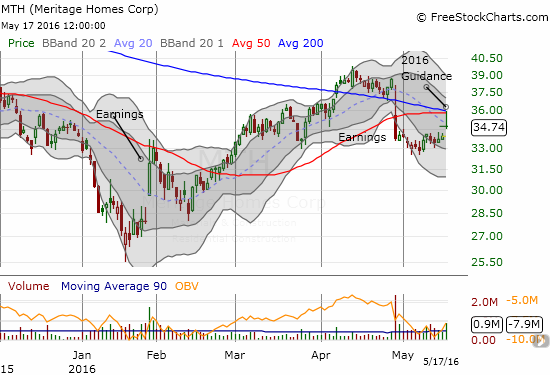

The market initially reacted well with the stock gaining as much as 5.8% in a move that finally started to reverse some MTH’s post-earnings loss. The high of the day happened to occur right at converged resistance from the 50 and 200-day moving averages. The sellers took over from there and drove the stock back to a 2.4% closing gain.

Relatively strong guidance failed to end MTH’s post-earnings breakdown

Source: FreeStockCharts.com

In some ways, this guidance is “too late.” The seasonal trade on homebuilders ended with the onset of Spring selling season, so traders and investors will be less inclined to buy homebuilder stocks. The guidance is also late in the sense that talk about Fed rate hikes is likely to speak louder than MTH expectations. That Fedspeak took on a new volume this week. Finally, the guidance came late in that analysts pressed management less than three weeks ago for guidance that was not forthcoming. The lack of visibility surely motivated some investors to sell until further notice.

During the Q&A portion of the last earnings conference call, Chairman & Chief Executive Officer Steven J. Hilton appeared to get irritated with the constant probing. He even became a bit defiant or defensive. The quotes are from the Seeking Alpha transcript of the conference call).

First this…

“It’s too early, I think, for us to commit to a very specific pinpoint number. It’s certainly possible, I think, for us to match the gross margin that we had last year…But I don’t want to commit whether it’s going to be 19% or 19.2% or 18.8% or specifically what it is, but it’s very, very possible that they could match up to last year, so.”

Leave A Comment