F is for Failure.

It’s also for Finance Ministers and F is also the grade they got at this weekend’s G7 meeting after failing to accomplish anything to calm the markets. As you can see from the Nikkei chart, Japan’s markets opened down a quick 2% before recovering half as it gyrated wildly into the close after testing 16,666, which is how the Banksters signal their minions that the fix is in and they have control.

For those of us not looking for Satanic messages from the trading floor, 16,500 is a strong (40% of the run) retrace from the bottom we called at 15,900 back on May 4th (good for a $5,000 per contract gain) to the top we called at 16,900 on May 11th (good for a $2,000 per contract gain) so you’re welcome for those! Remember – I can only tell you what the markets are going to do and how to make money trading them – the rest is up to you…

16,700 is the 20% (weak) retrace and, per our 5% Rule™, so upside resistance there is a bad sign and, if we bounce between there and 16,500, we’re likely consolidating for a move down, which is likely if Japan fails to get permission to further devalue the Yen by the end of the G7 Bosses Meeting on Friday. So we can look forward to another week of rumors and innuendo but the fun won’t end there as OPEC then has their meeting on June 2nd. Have I mentioned how much I like CASH!!! lately?

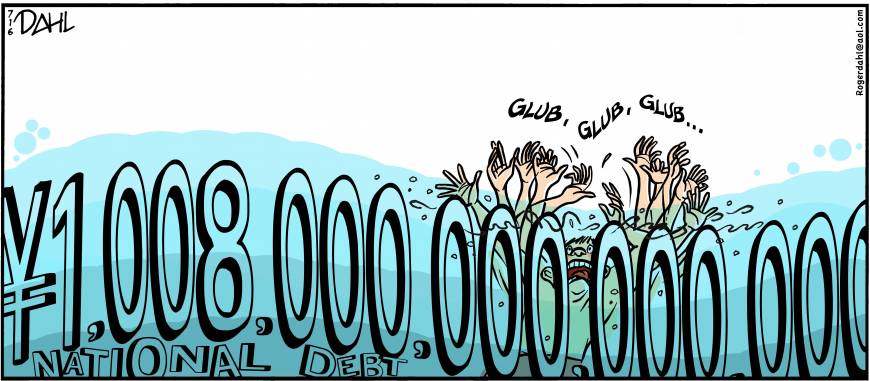

The lack of consensus over which policy levers to pull comes as Japanese Prime Minister Shinzo Abe prepares his heavily indebted nation for what may be another dose of spending to help the struggling economy. Ideally, he’d like the blessing of his G7 peers before doing so, but expectations are low that national leaders can go one step further on any economic accord when they meet in Japan later this week.

“Globally coordinated stimulus and cooperative exchange-rate management look a distant prospect amid deep G-7 divisions,” this weekend’s G7 meeting, co-head of Asian economic research at HSBC Holdings Plc in Hong Kong. “Japan’s desire to attain acquiescence for intervention to prevent Yen strength ?is running into resistance from trading partners worried about their own competitiveness amid sluggish growth.”

Leave A Comment