Disney (NYSE:DIS) has seen mixed results so far this year with the ESPN subscriber issue weighing on the company’s share price. On the other hand, Disney’s parks and studio segments have been returning impressive results. Stripping out the headlines, I am interested in determining whether or not Disney and its current dividend yield of 1.5% belongs in my dividend growth portfolio. Thanks to David Fish and his U.S. Dividends Champions list for the dividend streak and subsequent Dividend Growth Rates (“DGR”).

QUICK SCREEN

VALUATION

Disney stock has been range bound for the better part of 2016, is trading far below its 52-week high, and has significantly underperformed the broader market.

(click to enlarge)

Source: Yahoo Finance

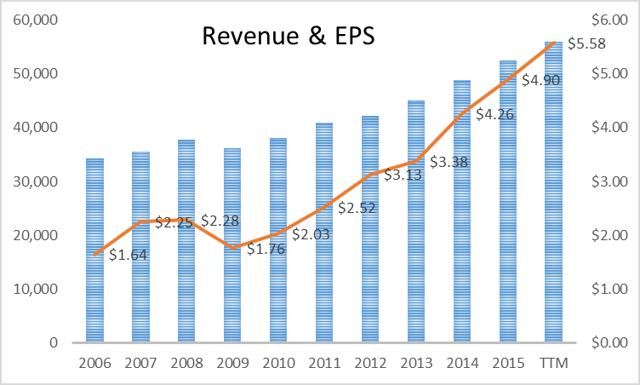

Despite its under-performance, Disney is not particularly cheap trading at a 17.1 PE and trading well above its Graham number. That being said, Disney is a high quality company that typically commands a premium and has consistently been growing revenue and EPS.

(click to enlarge)

Source: Morningstar

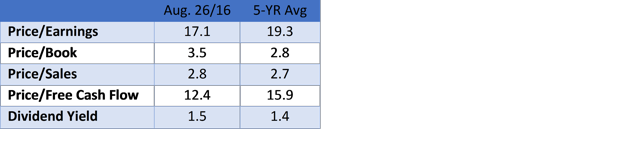

When compared to its historical 5-YR averages, the results are somewhat mixed:

(click to enlarge)

Source – Morningstar

Disney is currently trading at a discount to 5-Yr historical averages on a P/E and P/FCF basis and above 5-Yr historical averages on the P/B and P/S ratios.

Morningstar has a fair value on the company of $134.00 and believes it to be undervalued based on their implied P/E of approximately 24 times their fiscal 2016 EPS forecast and 15 times 2016 EBITDA.

DIVIDENDS

At first glance, Disney’s current 1.5% yield is not overwhelming and at the moment falls short of my 2.5% minimum requirement for portfolio inclusion. However, the company still warrants further consideration given that both its 3-Yr and 5-Yr growth rate is 31% and I believe high dividend growth/low yield stocks still have a place in a diversified dividend growth portfolio. Using the following estimates, I will determine what DIS’s dividend could look like in 5 years.

Leave A Comment