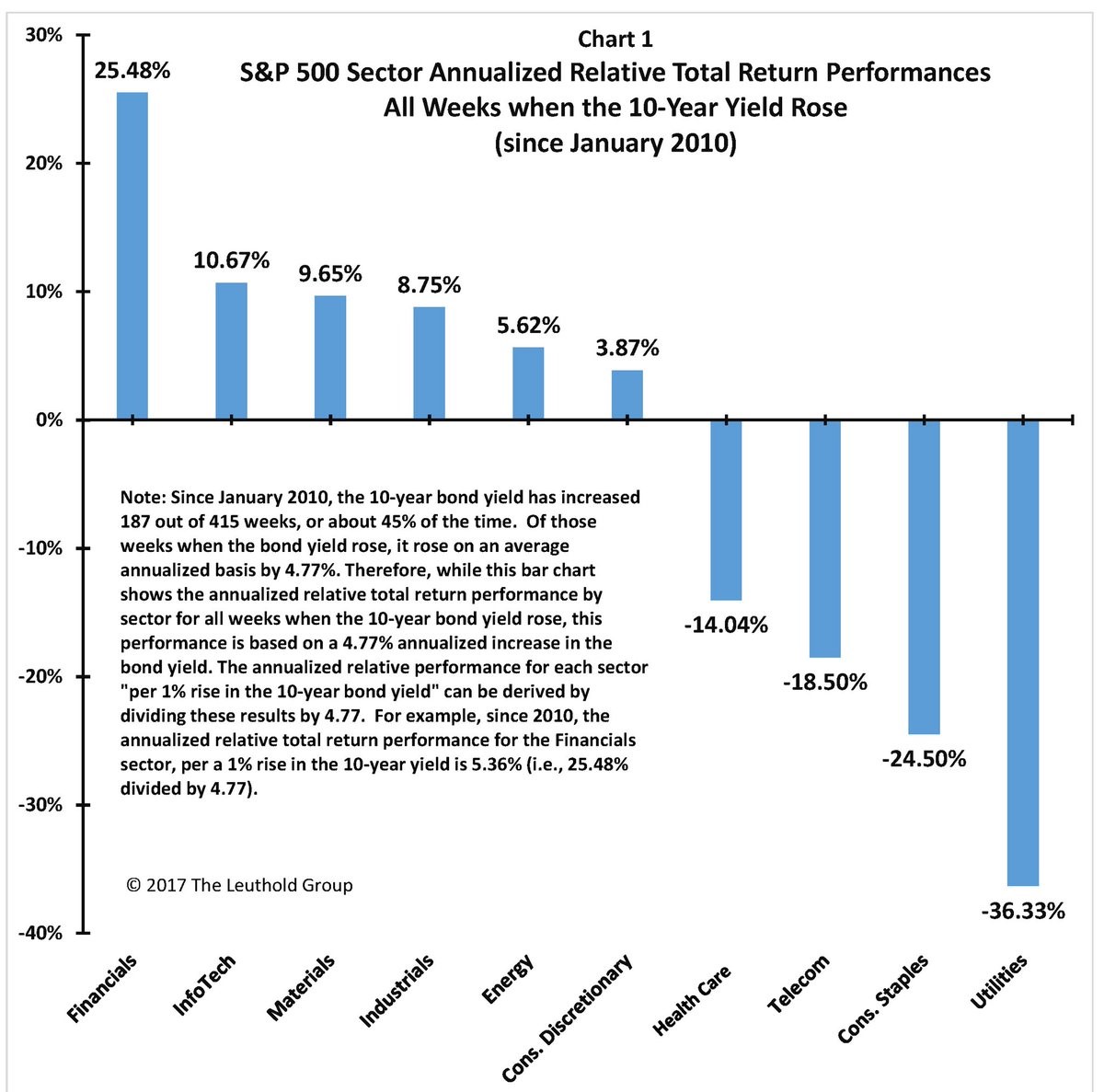

Financials Do Well When The 10 Year Yield Rises

We’ve discussed which sectors do well when the yield curve flattens. Now let’s look at which sectors do well when the 10 year bond yield goes up. The 10 year bond has gone up 45% of the time since 2010. I think inflation will increase in the next year. This should increase long bond yields. With this in mind, it makes sense to buy financials and sell utilities. There are a few trends I’m following. As I mentioned, the yield curve is flattening and inflation might increase. The other two are the effect of the tax cuts and QE tightening. The strategy investors should employ is to figure out which sectors do the best in all circumstances combined and buy them. The best way to invest is to make bets in which you have multiple ways to win. Buying a sector which does well at the end of the cycle when treasury yields are rising would help you do just that.

Indian & U.K Effected By Public Policy

The two markets which were the most negatively effected by politics in 2017 were the U.K. and India. Brazil is lucky its economy recovered in 2017 as it avoided making this list again even though there have been a few corruption scandals among its public officials. The U.K. has struggled as I discussed in my article on the Brexit. The uncertainty and the responses to this vote have been negatively impacting the economy. The establishment in change doesn’t like the concept of a Brexit, so they will be taken kicking and screaming towards the finish line. The battle to figure out which path the country goes down has led to uncertainty. The chart below shows the negative impact on the country’s economy. As you can see, the U.K. has fallen from having the highest GDP growth rate in the G7 to the lowest ever since the referendum. It is dragging down the minimum growth among the G7 nations as most experienced a rebound in 2017. The possible results of Brexit are anywhere from a severe decline in trade growth to very little changing.

Leave A Comment