Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly.

The most common explanation for the pullback in stocks – 6% doesn’t even qualify as a correction – is rising interest rates but I think it is a bit more complicated than that. Asset prices are obviously impacted by the discount rate applied but they are also driven by expectations regarding the stream of cash flow they generate. Changes in either – or both – can cause a change in investors’ perception of the value of the asset. The discount rate has obviously risen lately and the Fed has been about as clear as it ever is that the rates over which it has control will continue to rise.

But as I said in my Global Asset Allocation update, I think the more relevant factor in this case is the cash flow or earnings. What is interesting though is that while stock investors seem concerned, bond investors seem to be saying that whatever is driving earnings expectations won’t have an impact on growth or inflation. I suppose that could be true in the short term but I don’t think it will in the long term. If tariffs reduce corporate profits, they will eventually impact overall economic growth.

Still the fact is that it is hard to find much to worry about in the economic statistics or the market based indicators we follow. The housing market is the most obvious weak spot right now but that sector has diminished in importance in recent years. Could a weakening housing market be sufficient to pull us into recession? If it is that alone, I think the answer is no. If the implosion of the fracking industry a couple years back wasn’t enough to do it, I doubt housing would either.

It is important to remember that stock prices are more volatile than bonds and move pretty independently of the economy in the short run. Emotion is more important than facts and about all I can say for sure right now is that fear is winning out over greed right now when it comes to risk assets. I believe the source of the fear is the impact of tariffs but to be honest with myself I don’t know that to be true. That could be my own bias showing through. Maybe investors are concerned about the election or Italy or Saudi Arabia or all of the above. But they are worried for sure.

As an investor it is important not to overreact to every squiggle in the stock market. Our review this month shows that the economy hasn’t changed all that much and so neither should the long term outlook for stocks. The Fed has talked repeatedly about “normalizing” interest rates and they are well on their way to doing so. The volatility we are seeing in stocks is also a return to normal. Corrections of 10 -20% are normal and should be expected. Bear markets, on the other hand, are usually driven by economic changes – recession. And right now, the odds of recession remain low.

Economic Reports

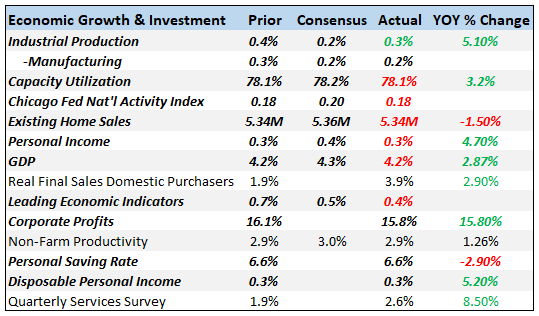

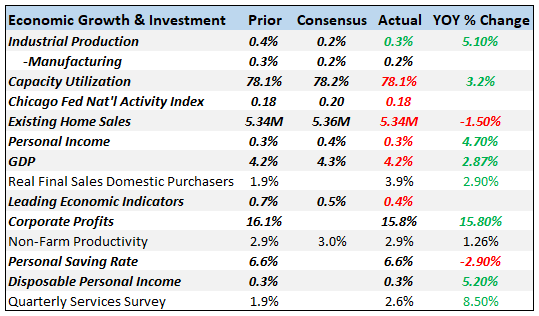

Economic Growth & Investment

The Chicago Fed National Activity index is one of the broadest indicators we follow and it continues to show an economy growing slightly above trend. The three month average for the CFNAI is 0.24 where a reading of zero indicates growth at trend (which is around 2.3% right now). While the economy does not appear to be in danger of falling into recession, neither is it ready to boom, the President’s claims notwithstanding.

Probably the most worrying stat in this group is the existing home sales number. The housing market is just struggling right now. The limiting factor is hard to pinpoint but is probably a combination of rising mortgage rates, high prices, slow income growth and high debt levels, especially among first time buyers.

Leave A Comment