Back in 2011, Standard & Poors’ shocked the world, and the Obama administration, when it dared to downgrade the US from its vaunted AAA rating, something that had never happened before (and led to the resignation of S&P’s CEO and a dramatic crackdown on the rating agency led by Tim Geithner).

Nearly seven years later, with the US on the verge of another government shutdown and debt ceiling breach (with the agreement reached only after the midnight hour, literally) this time it is Warren Buffett’s own rating agency, Moody’s, which on Friday morning warned Trump that he too should prepare for a downgrade form the one rater that kept quiet in 2011. The reason: Trump’s – and the Republicans and Democrats – aggressive fiscal policies which will sink the US even deeper into debt insolvency, while widening the budget deficit, resulting in “meaningful fiscal deterioration.”

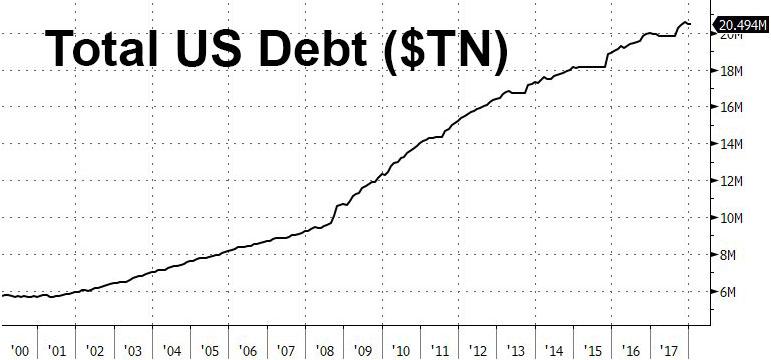

In short: a US downgrade due to Trumponomics is inevitable. And incidentally, with today’s 2-year debt ceiling extension, it means that once total US debt resets at end of day – unburdened by the debt ceiling – it will be at or just shy of $21 trillion.

We expect if not a full downgrade, then certainly a revision in the outlook from Stable to Negative in the coming months.

Here’s Moodys:

Leave A Comment