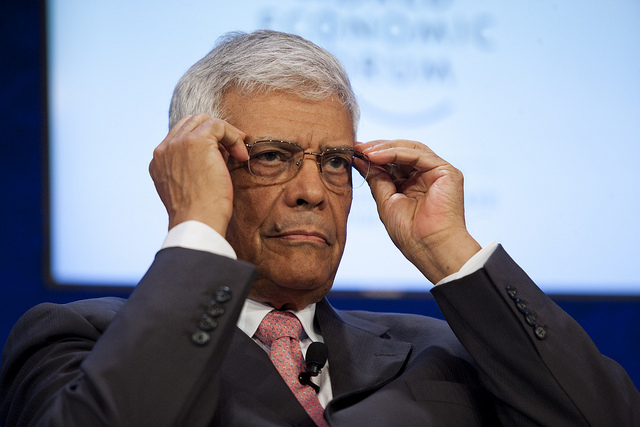

Image via World Economic Forum / Flickr; Abdalla Salem El-Badri, Secretary-General, Organization of the Petroleum Exporting Countries (OPEC)

The pace of the economic data picks up steam today with a busy economic calendar. But ahead of today’s highlights, a quick recap from yesterday.

The Japanese yen extended gains leading to USDJPY falling for two consecutive days. The dollar closed at 109.53Yen after a brief test to post a 10-day low at 109.05. Today’s early trading session is seeing the dollar extending its declines and a close below yesterday’s low could see price move steadily to the 107 – 108 region which is a strong support level. The yen strengthened as it was officially confirmed that Japan would be delaying the proposed sales tax hike (for a second time). The implementation of the sales tax hike is now pushed into October 2019. Furthermore, questions on the uncertainty and effective of ‘Abenomics‘ are keeping the markets sour at the moment. The Japanese Nikkei 225 is trading weaker as well.

DBS, in its note earlier today, summarizes as follows: “This is not the first time for the consumption tax hike to be pushed back. The second delay this time may have increased investors’ concerns about economic uncertainties and skepticism about Abenomics. The postponement of the tax hike raises doubts over the sustainability of Japan’s public debt.”

In the US, economic data yesterday was fairly stronger than expected. ISM Manufacturing managed to beat estimates to post a healthy increase, but the dollar failed to capitalize on the positive data. US construction spending declined, and the Fed’s Beige Book showed that the US witnessed a modest – moderate economic growth in the early second quarter. However, AtlantaFed’s GDPNow is estimating that the second quarter GDP growth in the US might have expanded 2.50%. Also, the US auto sales data showed that consumer demand for new cars was easing pushing manufacturers to rely on sales or car rentals.

Leave A Comment