MyoKardia Inc. (MYOK) expects to raise $73.6 million in its upcoming IPO. Based in South San Francisco, California, MyoKardia is a clinical-stage biopharmaceutical that is developing therapies for rare and serious cardiovascular diseases.

MyoKardia will offer 4.6 million shares at an expected price range of $15 to $17. If the underwriters price the IPO at the midpoint of that range, MYOK will have a market capitalization of $408 million.

MYOK filed for the IPO on September 28, 2015.

Lead Underwriters: Cowen & Co. and Credit Suisse Securities

Underwriters: BMO Capital Markets, Wedbush Securities and Wells Fargo Securities

Business Summary: Clinical-stage Biopharmaceutical Developing Therapies for Cardiovascular Diseases

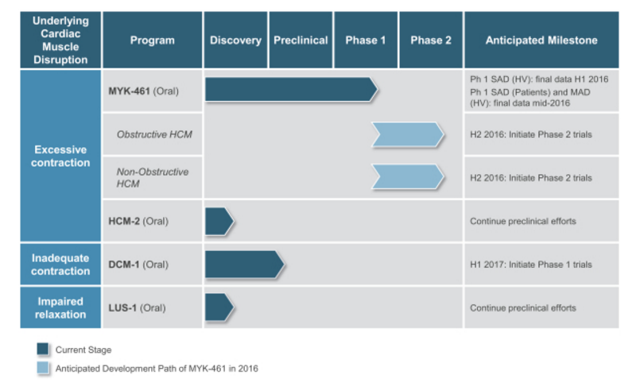

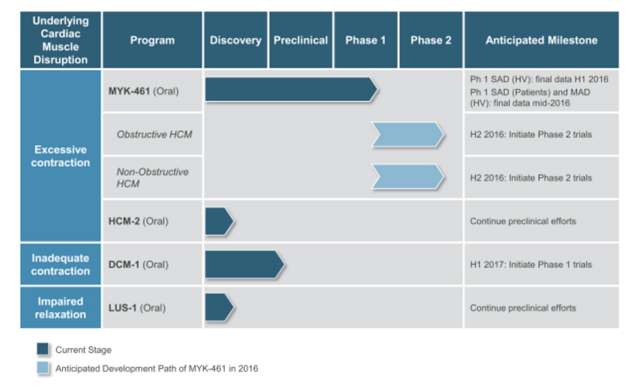

MyoKardia is a clinical-stage biopharmaceutical company in South San Francisco working on finding, developing and marketing treatments for rare, serious cardiovascular diseases. Its lead product candidate is MYK-461, which is in three separate Phase I clinical trials to test its efficacy at reducing severe cardiac muscle contractility that can produce hypertrophic cardiomyopathy (HCM).

In addition, the company is developing DCM-1, a product candidate designed to treat heritable dilated cardiomyopathy (DCM) by establishing normal contractility in a diseased DCM heart. Other product candidates include HCM-2, which is being developed to lower cardiac muscle contractility to normal ranges in HCM patients; and LUS-1, which is expected to counteract muscle disruption resulting in impaired relaxation of the heart.

(Source)

HCM is caused by genetic mutations, and MyoKardia estimates that up to 630,000 individuals in the United States suffer from HCM. DCM is caused by a biomechanical defect, possibly due to genetic mutations, and affects up to 400,000 people in the U.S. MyoKardia notes that no approved therapies exist for either condition, which are chronic and debilitating diseases.

MyoKardia intends to use the net proceeds to fund further clinical trials of MYK-461 and other pre-clinical, discovery and research programs. Any remaining proceeds will be used for development activities, working capital and general corporate purposes.

Leave A Comment