What Does History Say About Weak Commodities And Bull Markets?

You have probably heard the following argument somewhere in recent weeks:

Weakness in commodities, especially copper, is telling us the global economy is weak and another horrible bear market in stocks is just around the corner.

The argument seems rational; commodity prices are falling because demand is weak, which is a reflection of economic weakness. That may be true, but the price of any commodity is determined by supply and demand. Therefore, if there is a supply glut in a commodity, prices can fall even in non-recessionary periods.

The other bearish argument is also rational:

Weakness in commodities, especially copper, is telling us the global economy is weak and commodity producers are in big trouble.

There are always two sides to every story. According to the Rubber Manufacturers Association, it takes approximately seven gallons of oil to produce a tire. Do you think falling oil prices are hurting tire manufacturers, such as Goodyear? When input costs fall, profit margins go up. Thus, while commodity producers are not happy about weak commodity prices, there are countless businesses that benefit when raw material prices drop.

What Does History Have To Say?

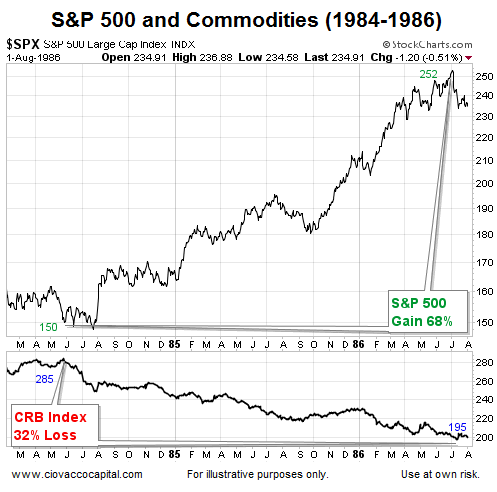

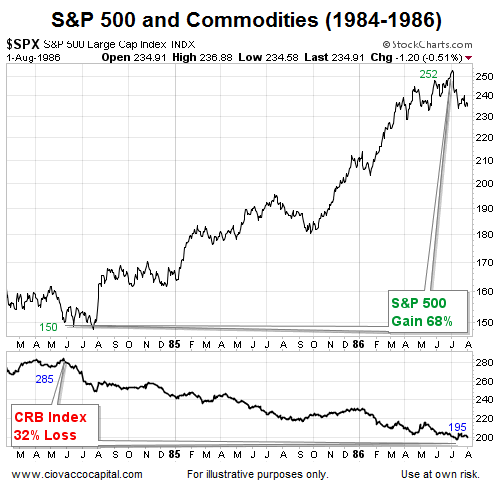

Our purpose here is not to say weakness in commodities is bullish for stocks, but rather to demonstrate with facts that weakness in commodities is not a showstopper for stocks. Said another way, is it possible for stocks to “kill it” for many years when commodity prices are dropping significantly? The chart below shows the S&P 500 gaining 68% during a period when the CRB Index dropped 32%. Was the economy in the gutter during the period when commodities dropped 32%? No, the average annual increase in GDP for 1984, 1985, and 1986 was 5.0%.

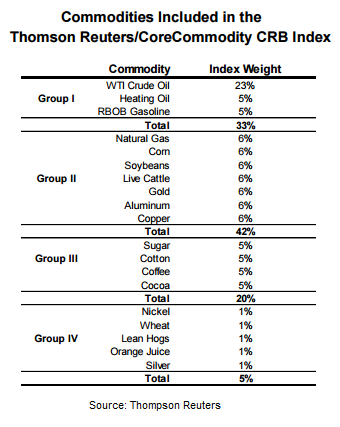

The CRB Index

The CRB Index is a basket of commodities comprised of the nineteen components listed in the table below.

1988-1993: Positive GDP And Gains In Stocks

Leave A Comment