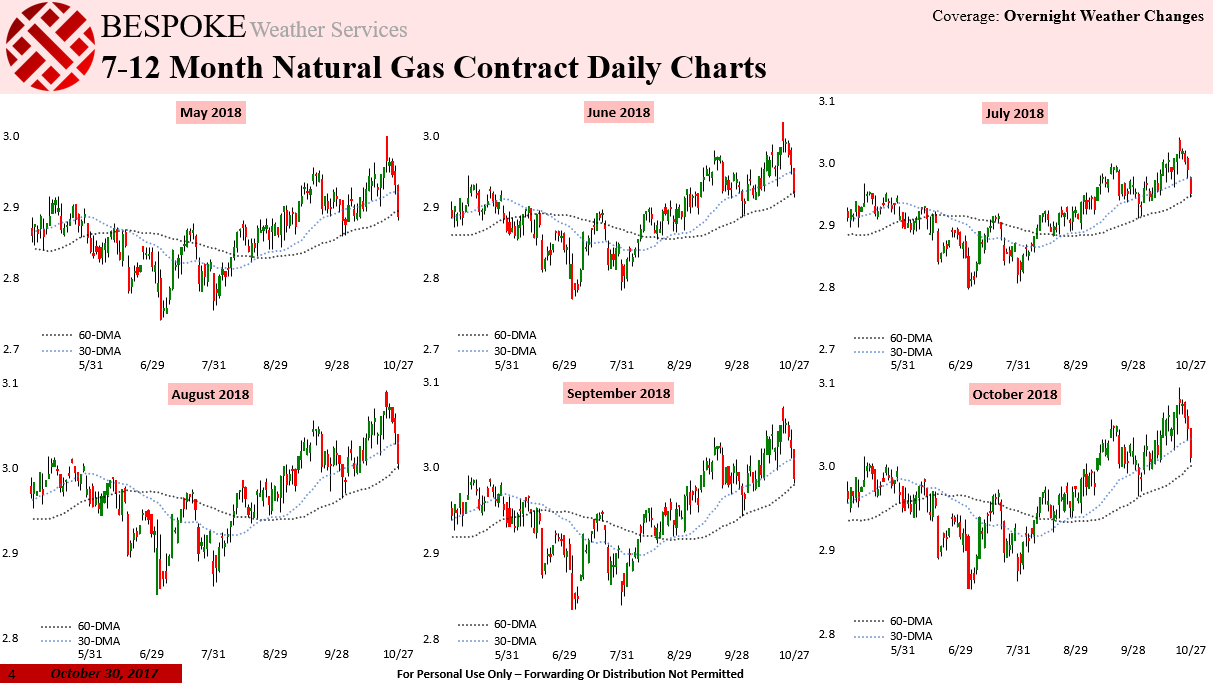

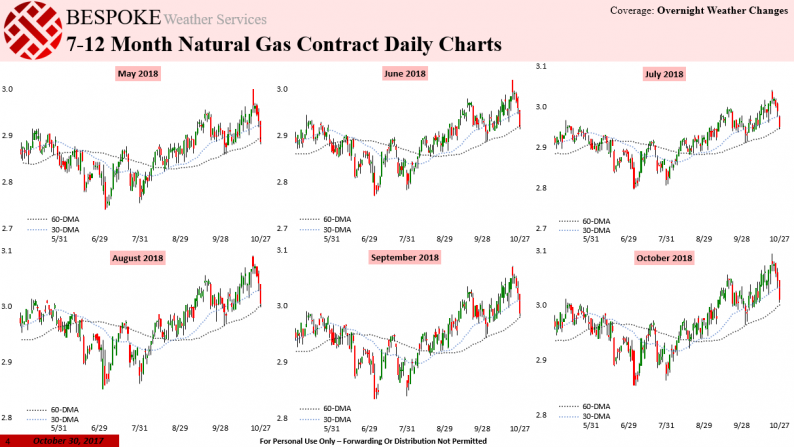

Heading into the trading day today it was apparent that technical weakness in the natural gas market was abundant. In our Morning Update, we highlighted how a number of 2018 contracts were sitting right around their 60-DMAs after heavy selling across the natural gas strip Friday. Any further decline and the support that has held these contracts since August would fail.

Selling was not just seen for 2018 contracts on Friday, however, as all the way out to 2023 we saw heavy selling that reversed recent buying trends.

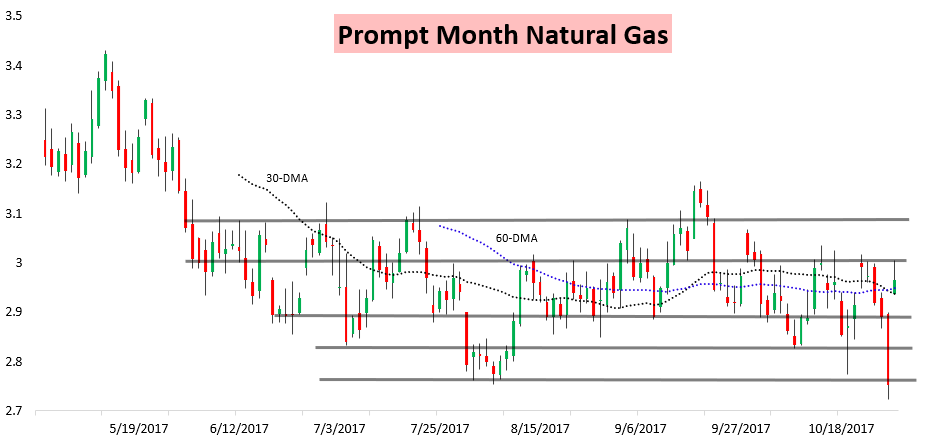

Today, however, was a bit more quiet. The new prompt month December contract traded in a narrow 7-cent range and settled up just a couple ticks on the day, reversing off resistance. Prices were still able to weakly hold the prompt month 30 and 60-DMAs as well.

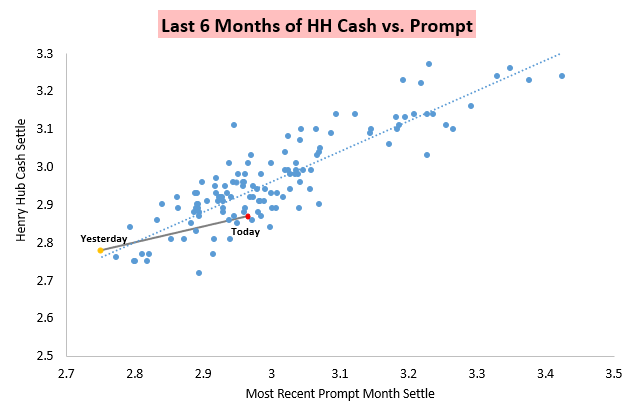

This came as cash prices rallied a bit on the day, helping to close the large gap between the new December prompt contract and weak Friday cash prices.

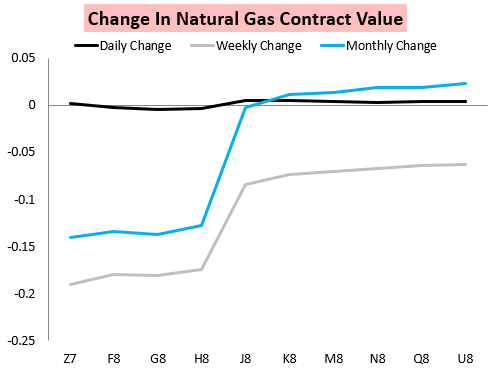

The front of the natural gas strip today was not all that supportive, however, as we saw later winter contracts lag a bit despite a tick upward for the December contract. The spring contracts did decently as well, though generally, the excitement was minimal with the main story continuing to be large weekly and monthly losses near the front of the strip.

Despite support holding, we saw H/J continue declining as traders see little that would have them concerned about stockpiles a bit below the 5-year average.

Yet the tick up in Z7/F8 would seem to indicate that it was more loosening in the supply/demand balance than bearish weather that pulled us down today.

Leave A Comment