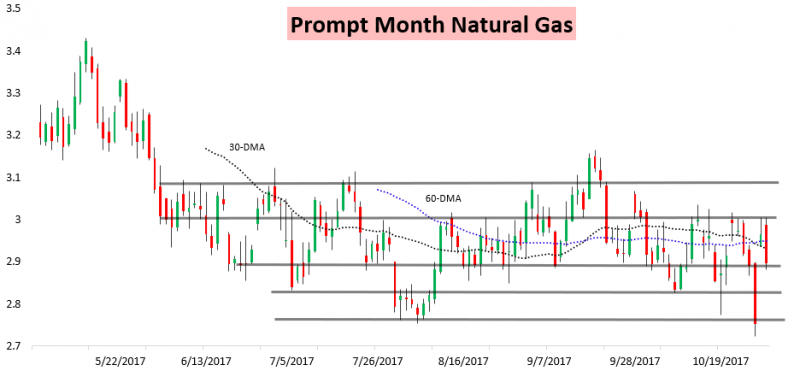

Sellers again hit the natural gas strip hard today, with the prompt month December contract falling over 2% on the day to settle near support.

Once again, selling was heavy further along in the natural gas strip than it has been as of late as well. As an example, the April 2018 contract has now convincingly moved below its 60-DMA for the first time since early August.

We saw cash weakness as responsible for some of this selling yet again, with cash prices declining significantly day-over-day more than the December contract.

Not all of this decline seemed weather-driven, either, as we saw Z/F bounce a bit once again as a more bullish run of the operational ECMWF pulled the front of the strip off support into the settle. Loosening in the supply/demand balance (due in part to elevated production levels) was thus also likely responsible for recent selling.

This comes as a rather classic La Nina-like pattern looks to develop in the long-term which will keep heating demand from getting as significantly above average. The latest 8-14 Day GEFS temperature anomaly output shows warmth across the South with cold risks limited primarily to the Great Plains (image courtesy of the Penn State Electronic Wall Map Site).

This fits with typical expectations in a La Nina for October/November/December, where cold risks across the South are dramatically decreased.

Still, a clear battleground will set up between a colder North and a warmer South, with a volatile natural gas demand forecast shaping up.

Leave A Comment