On Tuesday, it was announced that over seventeen million new vehicles were sold in 2015, the highest it’s ever been in United States history but, while the media claims that this record has been reached because of drastic improvements to the U.S. economy, they are once again failing to account for the central factor: credit expansion.

…Instead of learning from the mistakes that sent shock waves throughout most of the planet, the Federal Reserve has continued with its expansionist policies. Since 2009, the money supply has increased by four trillion dollars, while the federal funds rate has remained at or near 0%.

Automotive companies have taken advantage of the cheap borrowing costs, increasing vehicle production by over 100% since 2009:

Source: OICA

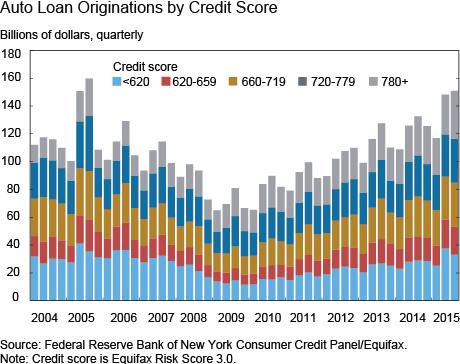

In order to generate more vehicle purchases, these companies have incentivized consumers with hot, hard-to-resist offers, similar to the infamous “liar loans” and “no-money down” loans of the 2008 recession. Dealerships have increased spending on sales incentives by 14% since last year alone, and the banners in their shops now proudly proclaim their acceptance of any and all loan applications — “No Credit. Bad Credit. All Credit. 100 Percent Approval.” As a result, auto loans have increased by nearly $80 billion since 2009, many of which have been given to individuals with far-from-stellar credit scores. Today, almost 20% of all auto loans are given to individuals with credit scores below 620:

Source: New York Fed

Not only are more auto loans being originated, but they are also increasing in duration. The average loan term is now 67 months (that’s 5.58 years) for new cars and 62 (that’s 5.16 years) months for used cars. Both are record numbers.

Average transaction prices for new and used cars are also at their record highs. Used car prices have increased by nearly 25% since 2009, while new car prices have increased by over 15%. Part of this has to do with the increasing demand for cars generated by the upsurge in auto loans. The main reason, however, is that consumers — taking advantage of the accessibility of cheap credit — are purchasing more expensive body styles…

Leave A Comment