One of the world’s largest sovereign wealth funds, and one which ironically amassed the overwhelming majority of their wealth via rich oil reserves, is now looking to sell off some $35 billion worth of energy stocks. According to central bank Deputy Governor Egil Matsen, the move is intended simply to “spread the risks for the state’s wealth,” but one has to wonder whether the owner of 1.5% of the world’s stocks has decided that oil has now moved into a period of secular decline.Per Bloomberg:

Norway’s $1 trillion sovereign wealth fund proposed dumping about $35 billion in oil and gas stocks, including Royal Dutch Shell Plc andExxon Mobil Corp., to protect the economy of western Europe’s biggest petroleum producer.

The nation will be “less vulnerable” to a drop in oil by not being invested in stocks of companies in the industry, the Oslo-based fund said Thursday. The Finance Ministry said it would study the plan and decide at the earliest in “autumn 2018.”

“Our perspective here is to spread the risks for the state’s wealth,” Egil Matsen, the deputy governor at the central bank in charge of overseeing the fund, said in an interview in Oslo Thursday. “We can do that better by not adding oil price risk through the fund.”

While the fund says the plan isn’t based on any view on the future of oil prices or the industry, it will likely add pressure on oil producers, already struggling in a world where renewable energy is gaining sway.

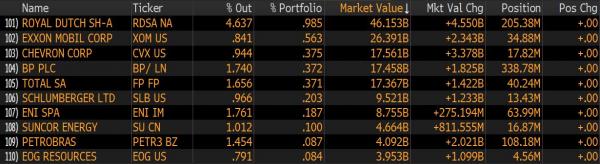

In light of this news, here is a list of Norway’s 10 largest energy holdings (valuesin NOK) that you should probably look to lighten up on at some point before they do.

Of course, roughly a year ago we scoffed at the wealth fund’s decision to respond to sinking returns and withdrawals required to fund budget deficits, deficits created by tumbling oil prices, by allocating another $130 billion in assets to what appeared to be an already massively overpriced equity bubble in return for an extra 40bps of “expected average annual real returns.” (see: Norway Buying $130 Billion In Global Equities As Sovereign Wealth Fund Continues To Bleed Cash). The extra equity purchases pushed the fund’s total equity allocation to a staggering 70% of their $860 billion in assets under management.

Leave A Comment