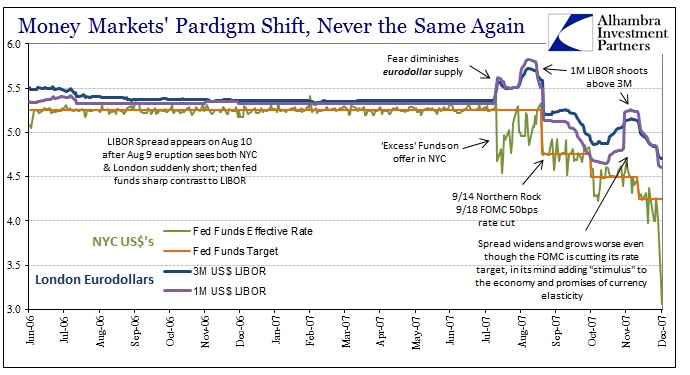

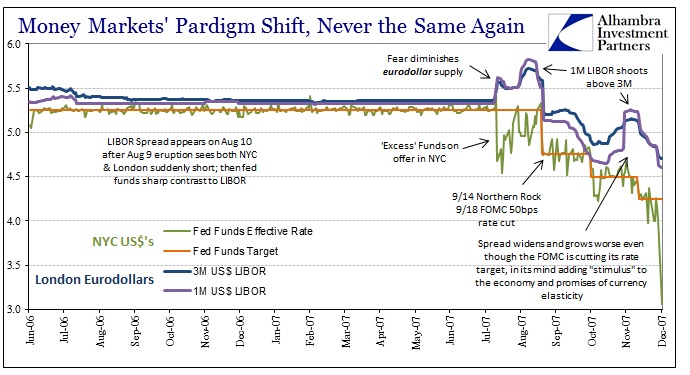

It is absolutely clear that the eurodollar system last functioned on August 8, 2007. Starting August 9, nothing would ever be the same. In describing and detailing how it got that way (the sudden fragmentation between “dollars” in NYC and London, for example) there is a natural tendency to compartmentalize even realizing the drastic implications of what it all meant. In other words, while understanding that global finance would never be the same it is still very important to realize that what happened then was not limited to eurodollar banking construction and operation. The global economy has never been the same, either.

When first confronted with what would become the Great Recession (and panic originating in London, not Wall Street NYC), policymakers somewhat understandably responded in orthodox fashion as if what was happening would be the usual if severe cyclicality. By the time Bear Stearns failed, however, they should have realized that greater forces were at work. Given the Fed’s mandates and really their own PR about themselves and their near “omniscience”, there was no excuse for not discerning the difference ahead of time. “Stimulus” is ineffective outside of cyclical conditions (and it is arguable inside them, too).

What followed was a campaign of ineptitude from one side of the planet to the other, and all flowing from that same mistake. I wrote in August 2014 on occasion of the seventh anniversary of the eurodollar break these conditions which meant why I was seeing the economy much differently than the FOMC and mainstream:

Why bring all this up, particularly after seven full years now? The first reason is simple, since from then on we have seen an absolute intrusion into market function of historic proportions and all in the name of “stimulus.” To what gain? We got the Great Recession anyway in spite of it all; and nothing like a recovery afterward. The very reasons for total market repression were born that day in August 2007, to be repeated at every questionable instance (like September 2008 when there was no real panic outside of banks).

Second, and perhaps more important with regard to the future, the FOMC demonstrated both a blindspot and a curious ignorance about the systemic weaknesses of “its” financial system. The crisis period shows not just one limited instance of the feebleness of monetary response, but rather the template by which monetarists will fail time and again. When you are captured by systemic ideology, you will never see the cracks in that system from looking inside out.

Leave A Comment