With all eyes on China’s Trade Data (due out shortly), propagandists aplenty are out en masse to explain a) China’s slowing economy is a “healthy rebalancing” (in other words, please do not pull your capital, or this will get very serious), b) The Fed should not raise rates (or we will bury them in Treasury selling and force QE4), and c) Credit demand is extremely weak (in other words, no matter what supply is jammed down the banks’ throats, it won’t reach the real economy).

The PBOC fixed the Yuan massively stronger (+0.28% – the most since Nov 2014)

and injects more liquidty:

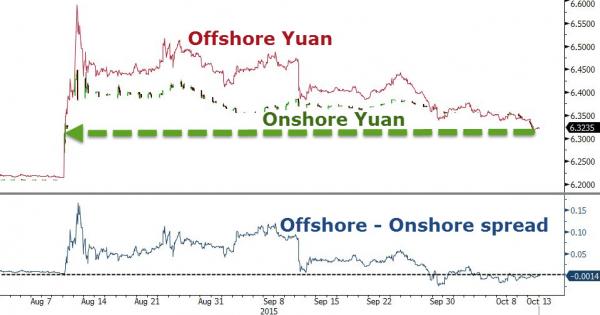

After 8 straight days of stronger fixes, On- and Off-shore Yuan is trading back at 2-month highs (having retraced most of the August devaluation) and notably erased all of the spread between the two rates…

Technicians note that CNY has broken below the 50DMA and retraced 50% of the August rally, targeting 6.30 as the next support….

The USD is notably stronger (against Asian FX) once again as Asia opens

* * *

As Reuters reports, The Fed just got its marching orders from China…

Now is not the right time for the United States to raise interest rates, given the global economic situation, China’s Finance Minister Lou Jiwei said in an interview published in the China Business News on Monday.

Speaking on the sidelines of the annual meeting of the World Bank and International Monetary Fund in Lima, Lou said developed economies were to blame for the global economic malaise because their slow recoveries were not creating enough demand.

“The United States isn’t at the point of raising interest rates yet and under its global responsibilities it can’t raise rates,” Lou was quoted as saying.

The finance minister said the United States “should assume global responsibilities” because of the dollar’s status as a global currency.

Leave A Comment