David Crane Resigns

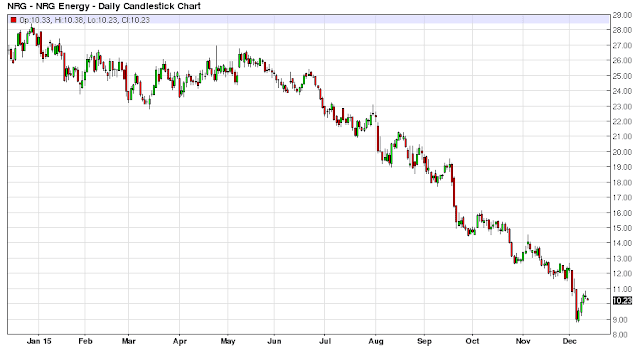

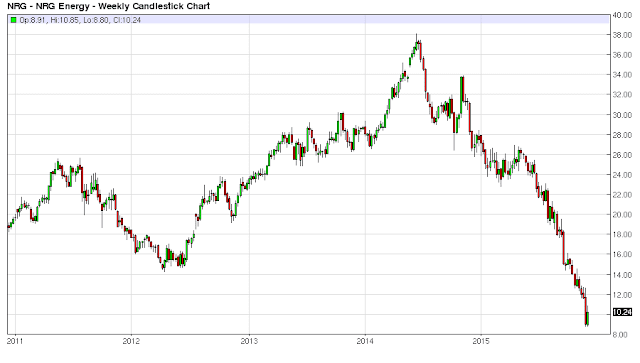

In case you missed it David Crane resigns Thursday and the stock gets hammered on Friday to the likes of almost 20% at one point in trading, putting in a low print of $8.81. Hopefully the more sophisticated investors out there bought some calls three month`s out as NRG Energy (NRG) is a definite takeout candidate with this shockingly low stock price given its actual assets.

Twitter Market Cap versus NRG Revenue

NRG Energy just for comparison`s sake has Revenue of almost 16 Billion while Twitter has Revenue of 2 Billion, NRG has a market cap of less than 3 Billion while Twitter has a market cap of 17 Billion. I could bore the reader with numerous other financial metrics, suffice to say, those interested in studying the balance sheet further will likely conduct their own due diligence.

NRG History

Here is the high level analysis of what led to NRG`s downfall, and the resignation of David Crane. David Crane aspired to be more than just a Power Generation company that maximized earnings each quarter. He wanted to take the Power Generation Company into the era of being a clean provider of electricity, and associated full services of residential products revolving around the retail side of the business and greener, renewable energy initiatives.

Growth by Acquisition Model

It is interesting because originally when Crane joined NRG their model was to increase earnings by acquiring Power Generation assets, with their big acquisition being the Texas based Power Generation assets which are real cash cows, they generate tons of cash flow for the company each year. This was going to be the model going forward, and if they would have stayed the course with this strategy David Crane would still be CEO of NRG and the stock would be much higher than it is today.

The reasoning here is yes natural gas prices are depressed, and there is going to be legislation necessitating higher costs for cleaner Power Generation. But it isn`t like demand for electricity is going anywhere, and not even the Obama administration is going to legislate Power Generators out of business completely; as there is leverage in the fact that electricity is a necessity. It can and will never be legislated out of business.

However, this even supports the case for more consolidation within the industry, especially for the existing fleet of Power Generation Power Plants of coal, natural gas and other fossil-fuel generation. Consolidation helps spread these increased costs over a larger scale and improves pricing power both from the rate side, and the associated costs in cleaning up the ‘dirty coal’ assets where necessary.

2007 Financial Crisis

But the Financial Crisis happened in 2007/08 and that changed financing for acquisition deals, some of the best financing that was available was through the Obama Administration in the form of Green Loan subsidies. This started NRG down the road to investing and developing projects in the Green space from Wind farms, to Solar projects.

Leave A Comment