Headline auto sales appear to be slightly better than expected for the month of October with a total SAAR of 18.0mm vs. estimates of 17.6mm. That said, GM reported a substantial inventory build which added roughly 50,000 units to monthly sales and we’re still waiting for data from Ford (F) after they delayed their release yesterday due to a “fire” at their corporate headquarters. On a positive note, incentive spending dropped MoM to 11.8% from the record high 12.6% recorded last month.

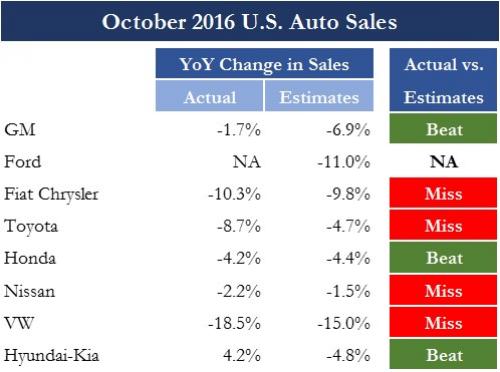

Among the large OEMs selling into the US market, GM and Hyundai (HYMLF) posted the largest beats while Toyota (TM) and VW (VLKAF) both posted substantial misses versus expectations.

Meanwhile, headline numbers suggested that Wall Street and Silicon Valley billionaires were gobbling up luxury vehicles with Porsche volumes up +10.7% YoY. That said, a look beneath the surface reveals a slightly different trend with all of the headline “beat” coming from sales of Porsche’s new low-priced Macan model that carries a starting MSRP of $47,500. Meanwhile, the higher priced 911 was down 45% YoY and Boxster/Cayman sales were down 20%….anything to keep up appearances…

But Porsche wasn’t the only luxury brand with lackluster sales in October as GM’s Cadillac sales dropped -9.4% and Toyota’s Lexus brand fell -19.7%.

With that, here are some more details:

General Motors: Overall GM sales declined -1.7% YoY on a 50,000 unit inventory build as inventory days jumped to 84 from 79 last month. Incentive spending dropped from 13.1% last month to 11.7% vs. the industry average of 11.8%. Fleet sales represented 19.5% of total sales, down 3.3% versus the previous year. Among the biggest GM platforms, Silverado Pickup sales fell -3.6%, Sierra dropped -18.7%, Malibu dropped -34.7%, Equinox dropped 11% and the Cruze gained 9%.On the luxury end, Cadillac sales dropped 9.4% YOY while Buick rose 7.4%.

Leave A Comment