Commodities and Asian shares recovered lightly after risk selling ran its course, with support from a higher CNY fix. Overnight in New York, the sell-off in credit and oil disrupted a two-day rebound and sent market back to the red.

Oil price led a return of risk dump in New York, after U.S. Department of Energy published a surprised 234,000 build in crude oil inventories. This contrasted to the 5.085 million draw in the prior week and an unexpected 3.9 million draw reported by API on Tuesday.

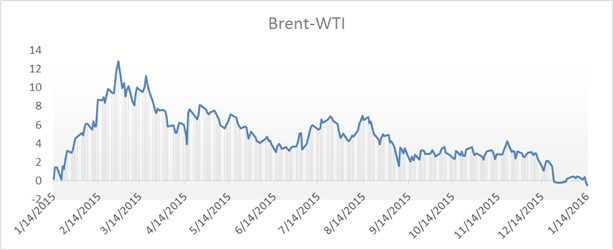

While pressure on WTI eased mildly, Brent oil lingers near its fresh low of 29.73 – established when regional stocks plunged upon Asia open. All eyes are on Brent and the narrowing divergence from WTI. Brent-WTI spread plummeted from 12.82 in February 2015 to negative -0.62 now.

Gold price has tested 1095.8 resistance level three times since early Asia. This level holds the key to a repeat of early 2016 rally or further choppy trading. A modest recovery of Asian risk assets currently places downward pressure on gold after it benefited from the overnight risk flight.

Copper price established a new 6-year low at 1.9425 together with a stock plunge upon Asia opening though it quickly pulled back up also in tandem with stocks. Copper and industrial metals remain vulnerable on the downside amid mixed market sentiment. Prices hold on to 1.9665 as a consolidation seems to take over.

GOLD TECHNICAL ANALYSIS – Gold price ticked up well above both 10-day and 20-day moving average on the downside. Mixed price action does not offer clear hint of direction, but rather a correction. Gold investors should stay put, waiting for volatility to wear out.

Daily Chart – Created Using FXCM Marketscope

COPPER TECHNICAL ANALYSIS – Copper price dipped to another fresh six-year low at 1.9425 although it quickly pulled back up. Momentum signals remain in oversold territory. Therefore the slide could prolong in copper, with the base case now shifts to a consolidation at current levels.

Leave A Comment