by Reverse Engineer, Doomstead Diner

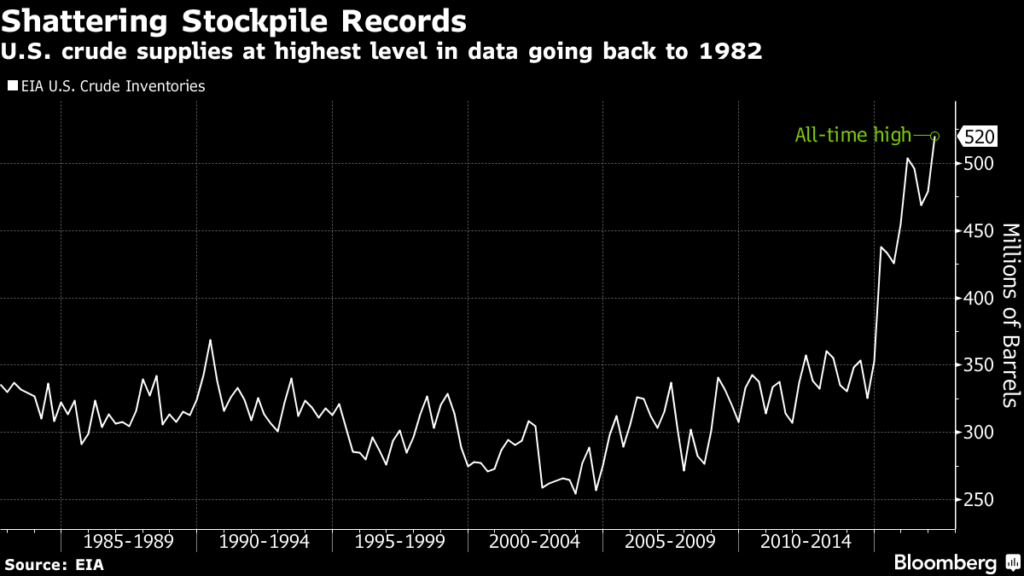

I ran across a chart on Bloomberg which is perhaps the best demonstration to date that the Oil Economy is in Full On Collapse mode now. The chart is of Oil Inventory in storage, and covers the last 35 years since 1982 of Oil Inventory in the FSoA, and is the first graphic below the picture.

Do you note the Hockey Stick nature of this graph? For 35 years until 2014, Oil Inventories were kept within a very narrow range. Supply & Demand were kept in balance by the folks in control of both the extraction of Oil and the production of money. A more or less steady “growth” rate of the entire system was maintained, as oil output and population increased, the money supply increased in tandem with it, a couple of percentage points ahead which provided return on investment for those in charge of creating the money in the first place. For everyone else, this appeared as Inflation as the cost of housing, food and just about everything else besides technological gizmos kept spiraling upward.

However, even through all the recessions through the 1980s to today, Oil Inventories always stayed inside this narrow range. That includes the Great Recession following the 2008 Financial Crisis. Something CHANGED in 2014 though, and my good friend Steve Ludlum of Economic Undertow pegged it to the month more than 2 years in advance with his “Triangle of Doom”. What changed at this time was that the cost of extracting oil went higher than the price the customers could afford to burn it at. The price crashed, from over $100/bbl down to $40/bbl or so, and briefly lower.

Charts by Steve Ludlum of Economic Undertow

August 2012 Prediction

April 2015 Reality

At this price, virtually nobody extracting oil makes a profit. A few folks like the Saudis still have Legacy fields they can extract oil at a profit at $20/bbl, but across the whole of Saudi ARAMCO their costs are a good deal higher than that. Here in Amerika, the Frackers may have got their extraction costs down to $60/bbl in some of their better fields, but they’re still not making a profit at $50/bbl. Just not bleeding money quite so fast,and if they are TBTF, then Wall Street keeps rolling over their loans to keep them floating another day. This is better in the short term than having to write down $Billions$ in losses, which then would make the bank itself insolvent.

Leave A Comment