Following Genscape and API’s 1.4mm barrel build estimates at Cushing

, DOE confirmed a 1.52mm build. However, API’s 3.45mm build overnight was shockingly opposed by DOE’s 3.41mm inventory draw – the 3rd biggest weekly draw of the year (as we suspect Canadian issues are impacting levels). Gasoline also saw an unexpected draw and Distillates drew down. Following last week’s big production drop (Alaska), US crude production fell once again – for the 16th week in a row. This combination of a surprise draw and lower production shocked prices of WTI above $45.50

API

DOE

DOE bucked the trend and reported a huge draw, 3rd biggest weekly draw of the year…

Following last week’s significant production drop (driven by Alaska much more than The Lower 48), production fell once again – the 16th week in a row to the lowest since Spet 2014…

API ‘weakness’ didn’t last long as oil pumped and dumped overnight in its usual stop-running way, but was fading into the DOE data and thensopared higher after DOE’s shock draw…

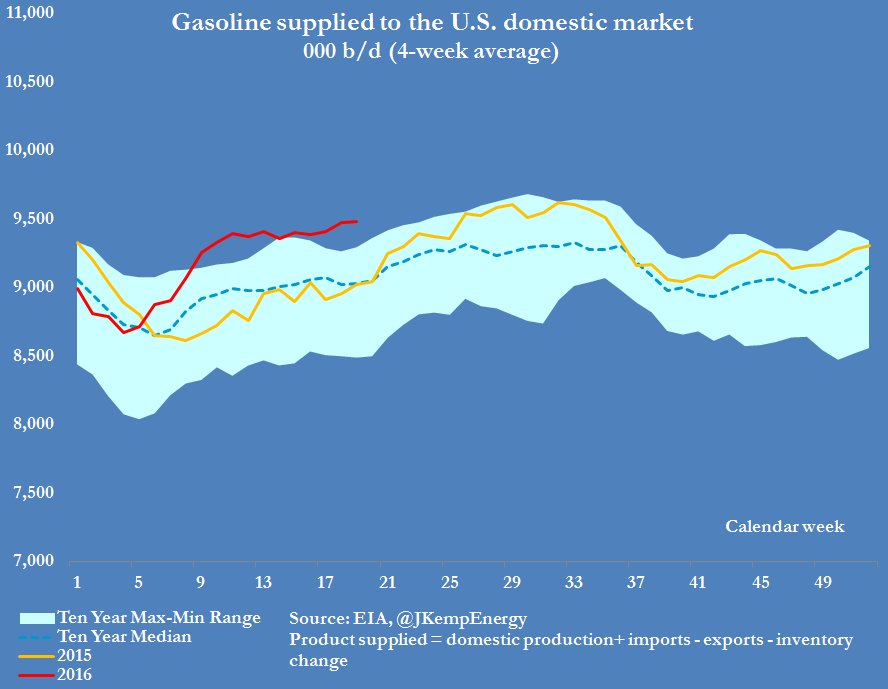

On the all important topic of marginal gasoline demand and stocks, in the past week, gasoline consumption continued to rise, and remains at a record – for this time of the year level…

…. while gasoline stocks dipped modestly in what was an expected seasonal draw.

Leave A Comment