“I had to cover my shorts.” That’s what my friend Matt told me after the company came out with its quarterly earnings and issued upbeat projections. I asked Matt, “how long are you going to keep shorting these companies. This is like the 10th time you’ve been forced to cover.”

I don’t remember anymore how Matt responded. But I do know he was later proved right to be wary. The company he was shorting in October 2000, Juniper Networks, had just reported earnings that were double year ago levels, and on strong revenue growth. The stock was up briskly on the news – eclipsing the $200 a share level. And Matt had to cover. But just one year later, when revenue was flat, beating expectations and causing the stock to soar 23%, the stock had already lost more than 90% of its value.

So how do you play this? I mean Matt was 100% right. And ironically, because we were working at an Internet company that seemed to us like total smoke and mirrors, we knew Matt’s scepticism made sense. But he was also early. And there was a lot of pain to endure until Juniper and stocks like it gave way.

I’m reminded of this story this morning by my Twitter feed. One story from Pedro da Costa talks about soaring household debt. And another tweet from Brian Klaas talks about putting nuclear-armed bombers on 24-hour alert. Yet Holger Tschaepitz notes the 15th consecutive gain for the Japanese Nikkei 225, a record streak. And James Crombie talksof record junk bond issuance in Europe.

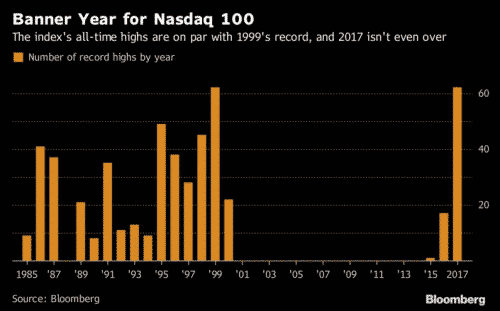

It was when Joe Weisenthal tweeted about record highs in the Nasdaq 100 that I thought of Matt’s shorting Juniper back in October 2000. Here’s Joe’s chart:

So how do you play this? Just last week I was telling you that there are zero signs of economic recession coming in the data. The one data series I like the most says the jobs market is stronger today than it was a year ago, 9 years into this expansion. So there’s no obvious economic break to stop the market freight train. And let’s not forget that it was 196 when Alan Greenspan mused aloud about “irrational exuberance”. The markets continued higher for another 4 years.

Leave A Comment