On December 3rd, 2015, the gold market completed a fifty-one-month bear market by touching down at $1,045.60; the market for Gold Miners, as represented by the HUI index, completed a fifty-two- month bear market bottoming on January 19th, 2016 at 99.09.

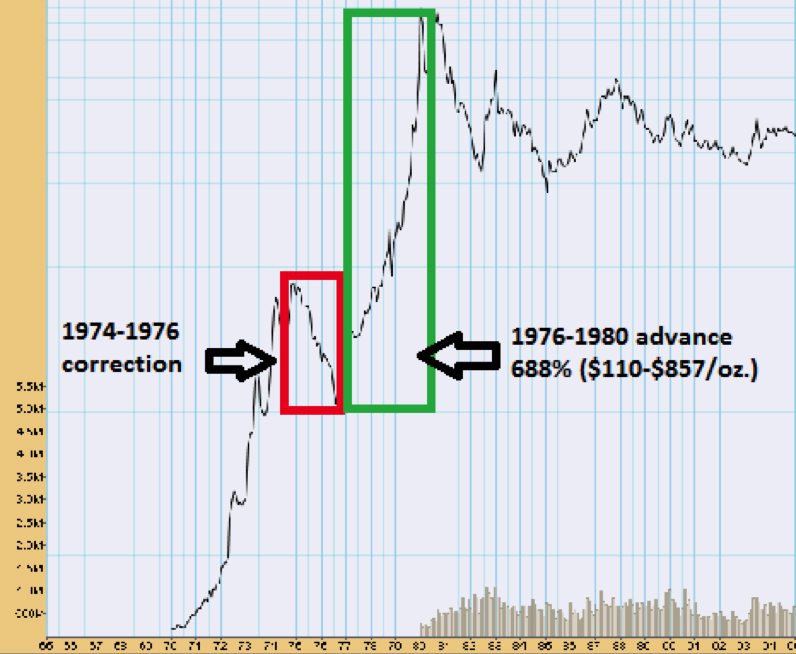

The home of a vast majority of junior exploration companies, the TSX Venture Exchange, recently completed a fifty-eight-month bear market finding its trough on January 20th, 2016 at 466.43. These three bear markets will go down in history among the most vicious bear markets ever. Some were longer (1988-1993) and some were sharper (2007-2008) but only one bear market compares in terms of misery and that was the 1975-1976 bear market that saw gold drop from $190 to around $110 after gold advanced from $35/ounce to $190 in reaction to Nixon taking the U.S. off the Gold Standard by abandoning the Bretton Wood Agreement in 1971. That bear, a precursor to the most dramatic, wealth-preserving ascent in gold’s history, was particularly acute because of the speculative mania that gripped the junior mining and exploration market from 1971-1975 during the initial blast to $190. When the correction began, investors were embarrassingly-long a vast amount of gold-related securities and even more so the penny miners that didn’t need gold (or anything else, for that matter) to be swept up in the fever. Naturally, when the price of gold began to correct from $190, it mirrored the September 2011 peak in gold above $1,900 and the HUI around 643 such that by the time gold bottomed in 1976, there were body-bags at the side of every road leading to Bay Street. Firms went under; salesmen droves taxicabs to supplement income; and the losses in customer accounts were mortally-large. However, it did turn up and by the time I entered the investment industry in May, 1977, the bulls were back in control, wounded and scarred, but back. I believe that we are today in that same early-stage period that we saw in 1977 with prices having bottomed but skeptics everywhere and very little public participation.

Therein lies the wonderment of opportunity for investors as they try to find a rational place to invest in a completely irrational financial world.

Long-term Outlook: The “Rhyming” of Events”

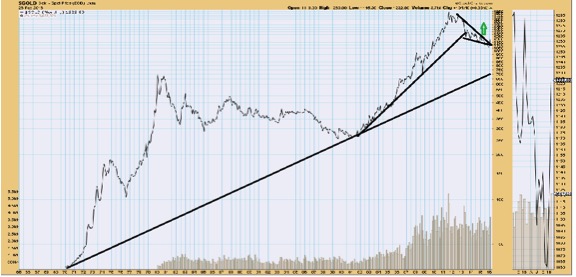

The long-term bull market for gold began in mid-1999 at around $250 per ounce after a near-twenty-year bear market. This initial advance had a ten-year consecutive year-on-year advance streak broken in 2011. The great debate in the world of gold analysts and technicians is whether the 1999-2011 advance constituted a “bubble” or was it simply the result of twenty years of credit creation and currency debasement disguised behind the façade of serial bubbles in real estate and stocks. For this gold prognosticator, the notion of a gold stock or gold bullion “bubble” is beyond ridiculous; all one need do is compare money flows into bonds and stocks versus gold and gold-related investments and the result is that many hundreds of times greater in “flow” is the dollar amount allocated to bonds (“debt”) and stocks than to the precious metals. Ergo, I view the long-term outlook for gold as unequivocally “bullish” with and even greater emphasis on the gold miners and explorers.

Leave A Comment