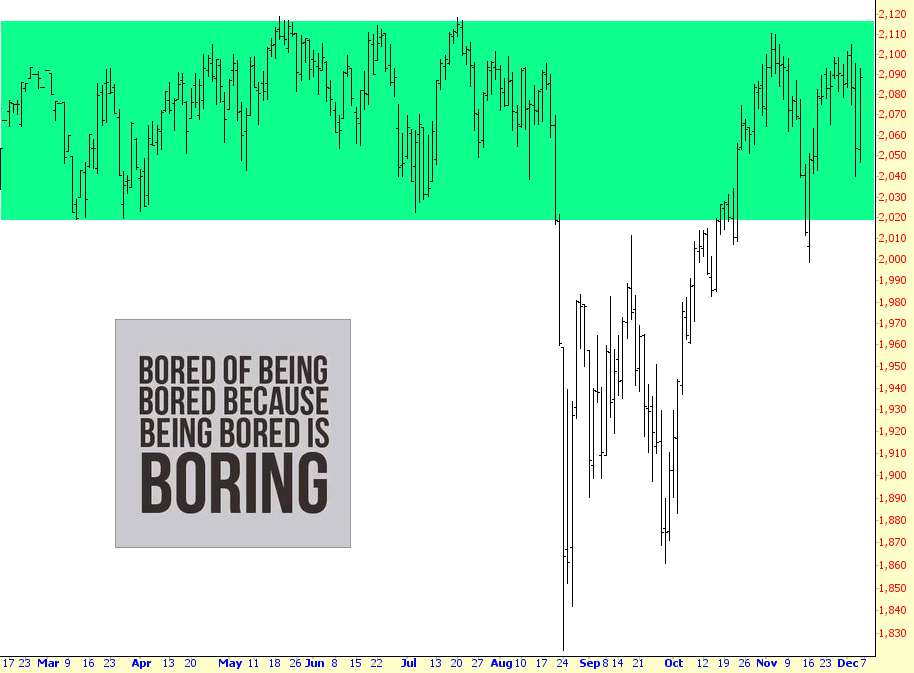

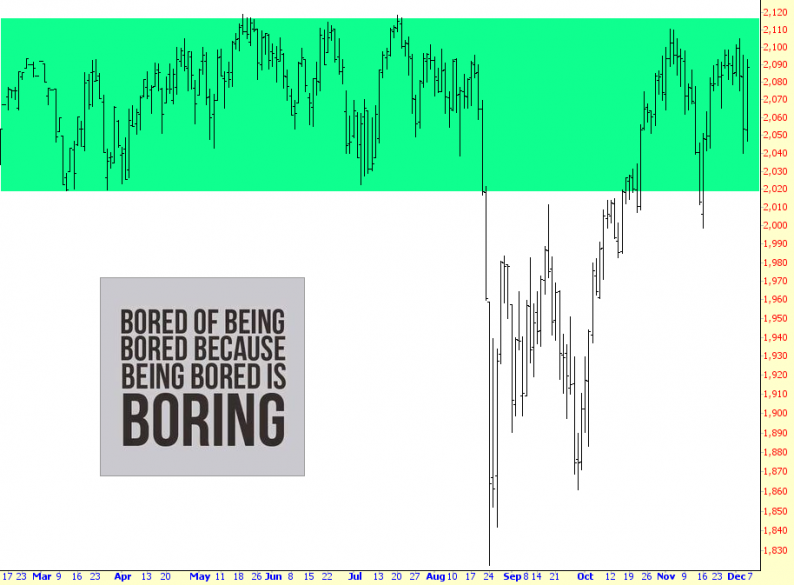

It probably is late enough in the year to start thinking about what might be in store for 2016. Let’s face it, on the whole, 2015 has been pretty much a crashing bore or sober disappointment. Neither bull nor bear can claim this as their year. The ES contract has been pretty much priced at 2050, give or take a few bucks, for almost all of 2015.

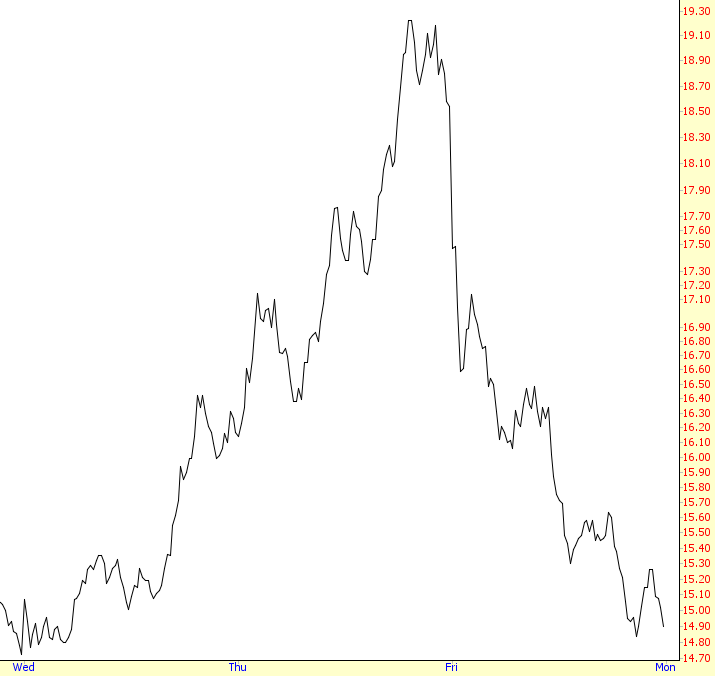

Last week, on Wednesday and Thursday, it looked like the bears might actually be back in the game. But a single speech by Mario Draghi (and, amazingly, an outright admission on his part that he did the speech on Friday specifically to counter the drop he caused on Thursday) undid almost all the bearish progress. The VIX completely round-tripped over the span of Thursday and Friday.

The index I continue to watch the most closely is the Dow Jones Composite. The graph below – dare I say it – is not bullish. The triangle pattern I’ve drawn represents, for me, the “roam zone” for months into the future.

The real question, though, is whether something next year could push the Dow 30 to break its own support line at about 15,300. If it does, that sets up a target price of 12,300. I know this sounds like science fiction, but I at least want to get the possibility out there. Suffice it to say, even a fraction of such a move would make the presidential election cycle even more interesting than it already promises to be.

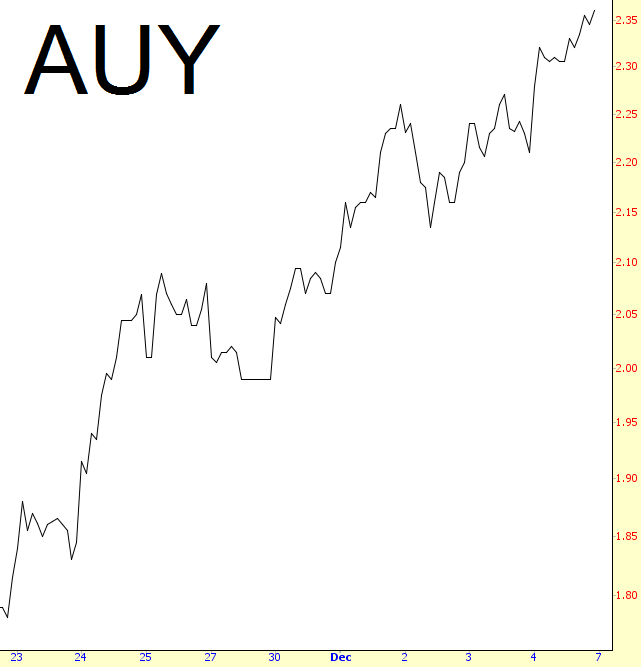

The one sector I’ve been cheering on as bullish is gold miners, and they’re really starting to show signs of life. The stock I’ve been touting as my favorite in this group, Yamana Gold (AUY), has a terrific week (shown below on an intraday chart). Maybe next year, precious metals will get their sea legs back.

In sharp contrast, I think emerging markets are a slow-motion track wreck. Even with the ridiculous rally we’ve had over the past nine weeks, EEM is still down about 25%, and the pattern below suggests much lower prices ahead.

Leave A Comment