Amid its “broadest slowdown in years” the US housing market faces prices for starter homes at the highest they have been since 2008, just prior to the collapse of the housing market, and August is confirming that prices are indeed becoming an issue.

Following the drop in Existing- and New-home sales (as well as another drop in mortgage apps), Pending-home sales missed expectations dramatically, dropping 0.7% MoM in July (+0.3% exp).

This is the seventh straight month of annual declines in pending home sales…

Lawrence Yun, NAR chief economist, says the housing market’s summer slowdown continued in July.

“Contract signings inched backward once again last month, as declines in the South and West weighed down on overall activity,” he said.

“It’s evident in recent months that many of the most overheated real estate markets – especially those out West – are starting to see a slight decline in home sales and slower price growth.”

Yun blames affordability (and supply)…

“The reason sales are falling off last year’s pace is that multiple years of inadequate supply in markets with strong job growth have finally driven up home prices to a point where an increasing number of prospective buyers are unable to afford it.”

The US housing data just keeps getting worse…

Again as we noted previously, none of this should come as a huge surprise since

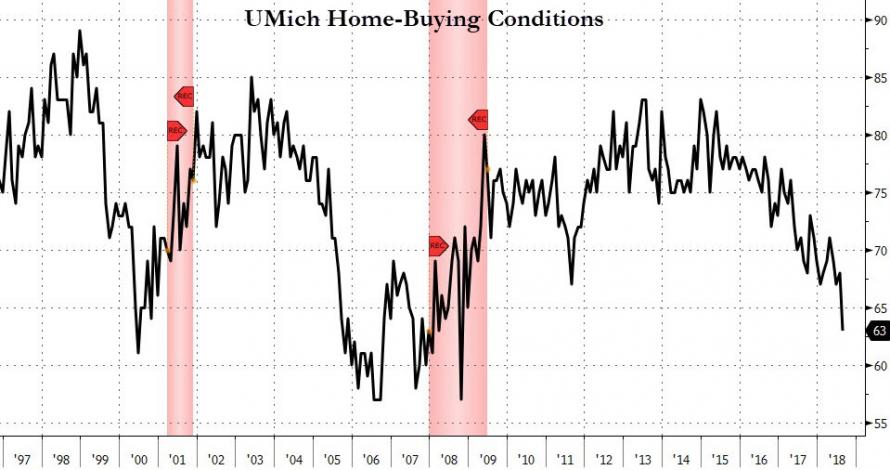

Sentiment for Home-Buying Conditions are the worst since Lehman…

With The Fed set on its automaton hiking trajectory, we suspect home sales will continue to lag.

Leave A Comment