We wanted to take a moment to examine the performance of the IPO market so far this year and highlight some interesting trends with graphs and pictures. So far July looks like it will be a pretty good month so the positive momentum for the year is set to continue. Here are some of the key bullets from our analysis:

And now onto the pictures:

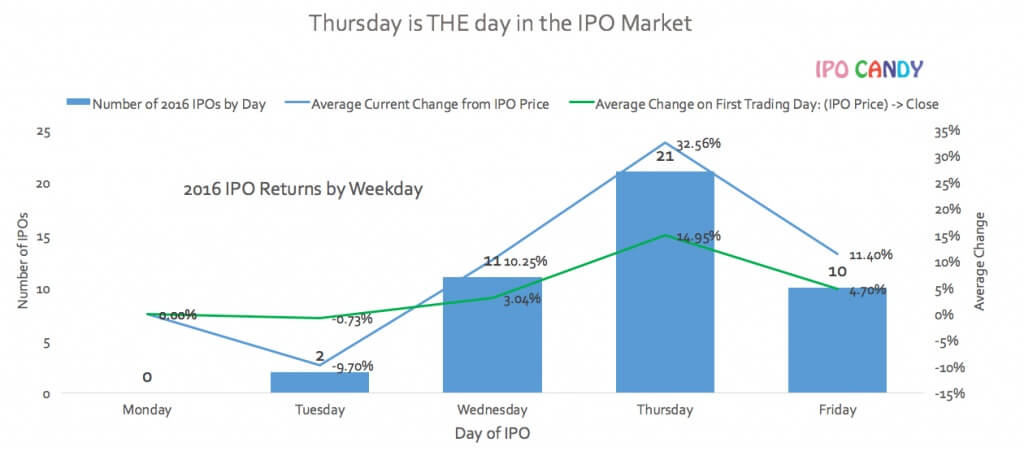

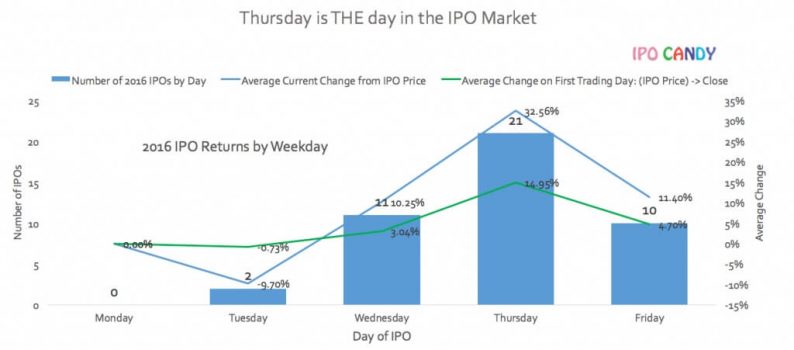

First and just for fun we looked at the year so far by the day of the week. Thursday is the big winner. Naturally the middle of the week is the preferred timing for most banks since it gives them a couple of business days to build the final book and nobody likes to price on a Friday.

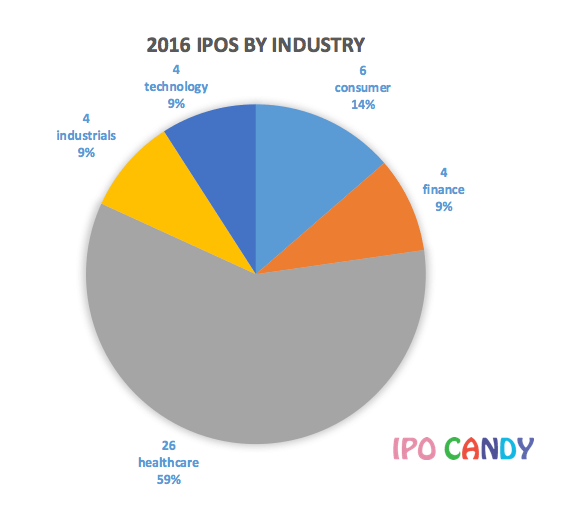

Healthcare is still dominating in terms of number of IPO transactions:

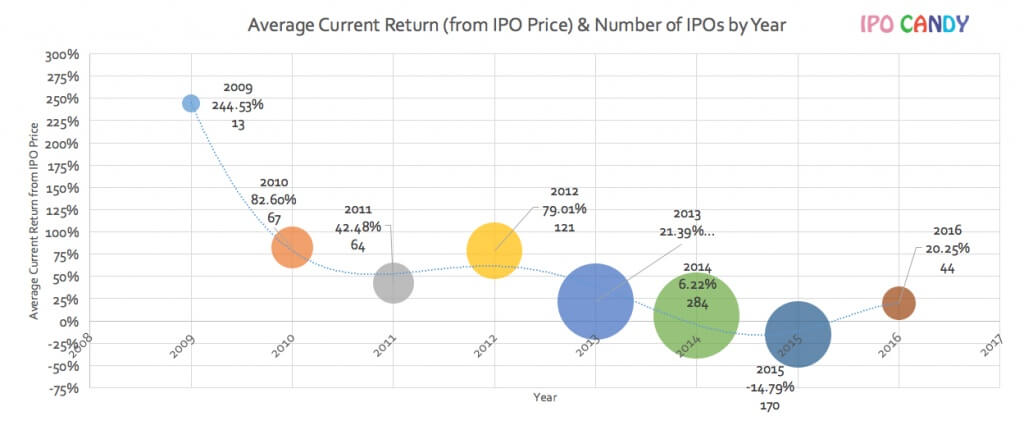

Looking at overall performance by year the returns in 2016 have been very good compared to the past two years:

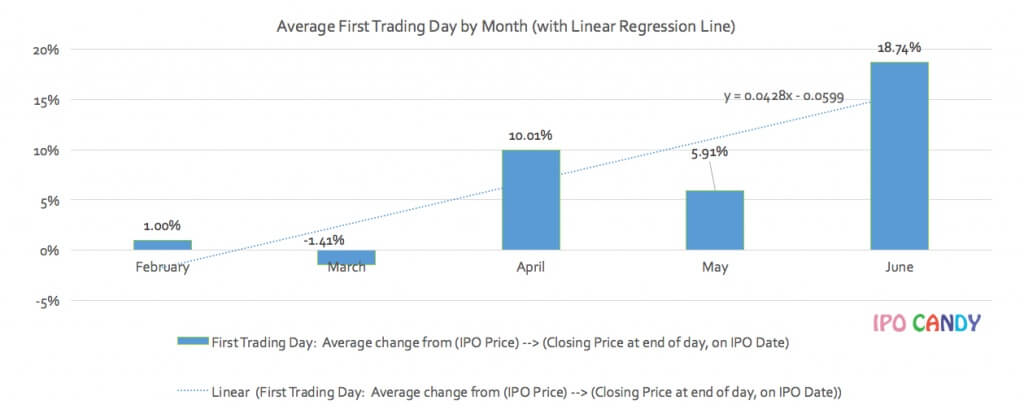

Over the course of the year volume has grown and returns have improved too.

The performance by industry shows that the few technology deals that got done did VERY well.

More to come:

Leave A Comment