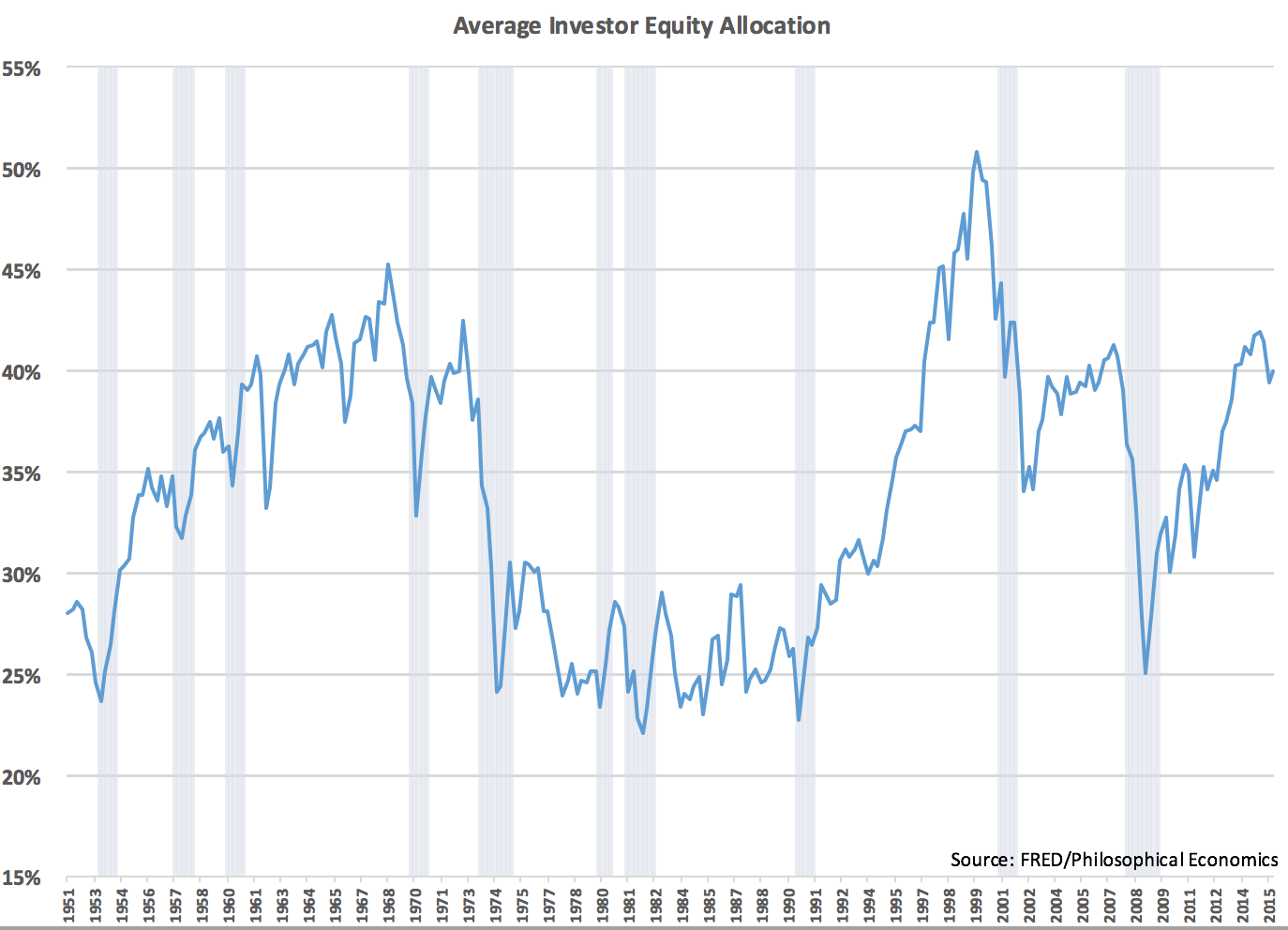

Investors may not like it, but they do own more stocks. The average investor equity allocation is now back to where it was around the 2007 market peak. This has some people worried that things are getting frothy once again. Maybe they are, but there are some legitimate reasons for the increase in equity allocations by households.

now back to where it was around the 2007 market peak. This has some people worried that things are getting frothy once again. Maybe they are, but there are some legitimate reasons for the increase in equity allocations by households.

Written by Ben Carlson (awealthofcommonsense.com)

Here are 7 legitimate reasons for the increase in equity allocations by households:

1. Low savings rates. Lots of people out there have very little saved for retirement. The only ways to remedy this situation are to save more money, work longer, lower your standard of living or take more risk. Many investors need to take more risk in their portfolios to try to make up for a perceived shortfall. This can be a risky proposition for those who can’t handle the additional volatility this strategy brings, but for many they see stocks as their only refuge.

2. Low interest rates. There’s nowhere safe to hide for high-quality income needs in today’s low rate world. The days of 5-6% Treasury yields are behinds us for now. The S&P 500 yields over 2% in dividends while the 10 Year Treasury yield is under 1.8%. These are two very different investment structures but many investors need to accept more risk for both higher yields and higher returns if they wish to accomplish their goals.

3. People are living longer. The odds of at least one person in a male-female couple reaching age 75 is around 90%. There’s an 80% chance at least one will live to 85 and a 40% chance one will survive to age 95. In the past people used to retire in their 60s and die in their 60s. Now people are living longer than ever. Many people will have an additional three decades or more in retirement without earning a working wage. Inflation can eat up a lot of your returns over 30 years, so people realize they need to get some growth in their portfolios if they wish to not outlive their money.

Leave A Comment