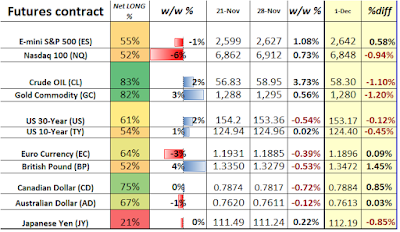

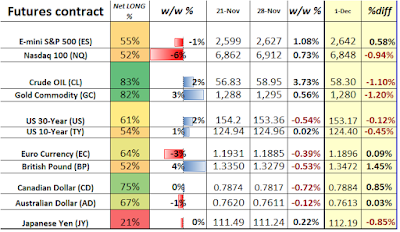

Speculators piled into the British pound, triggering a range breakout, according to the latest Commitment of Traders (COT) report. Equity markets remain resilient despite cautious positioning trends by (non-commercial) speculators and an increased bout of volatility. Meanwhile, speculators were mixed in terms of positioning vs the USD, but managed to up their extremely bullish bets in gold and oil.

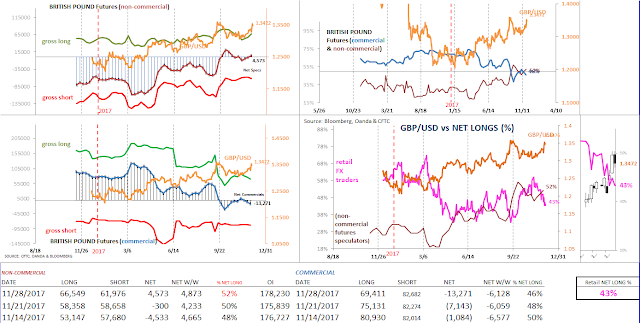

The most recent COT report highlighted that the overall (net long) position in British pound futures is now trending higher again, as it advanced the 3rd straight week to reach 52%. The retail FX population, meanwhile, has continued to scale back their net long position to just 43% (as of Friday’s close) from 59%, just a few weeks ago. These forces in sentiment typically translate into gains for the pound, which came to fruition last week after the GBP/USD broke-out of a 7-week rectangle (range consolidation) pattern. This bullish development suggests that while former range resistance in the 1.3340 is maintained to the downside, a re-test of the recent highs in the 1.3600/60 region remains likely in the near-term.

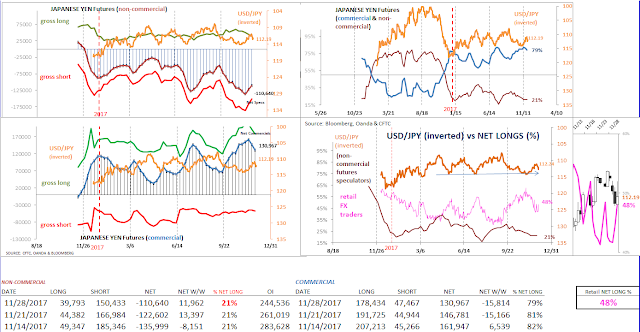

Just like everything else in the global financial markets, it was a choppy week for the Japanese yen, as it pulled back from its recent recovery off yearly lows (vs a trade-weighted basket of currencies). In the latest COT report, the yen continued to back off the largest net short position for the year vs the USD, but due to the paring of long contracts, the net long percentage remained unchanged. This reiterates what was already known, that the crowded yen carry trade has reversed, but due to its extreme short (79%) position, still has ample room to rally further. Meanwhile, retail FX positioning data pointed out that the retail population has started to buy into the yen, pushing the net long (by percent) up to 48% from 45% a week prior. While, the direction in sentiment remains mixed, the USD/JPY has clearly settled back into an 8-month range between Y111 & Y114. The technical picture, however, has stabilized a step further from a week ago, but the immediate outlook remains mixed as well. That said, there’s a slight (USD/JPY) bearish bias to the downside while the midpoint of the most recent range (just under Y113) continues to cap price-action to the upside.

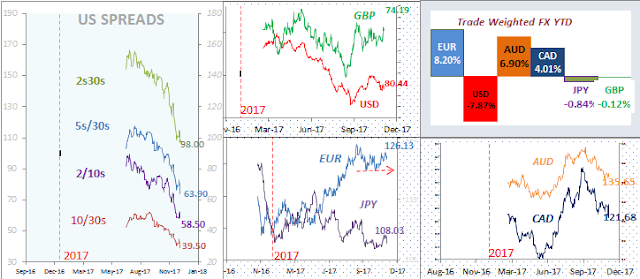

The EUR/USD began the week by pulling back from 2-month highs and was that was reflected in the latest COT report (into the Nov 28th close), as speculative euro positioning by non-commercial traders pared back positions from what has recently been one of the largest net long position by (non-commercial) speculators on record. According to recent retail trading data, the retail population continued to be sellers into bouts of euro strength and buyers on pullbacks, which partly explains why price action in the EUR/USD has been choppy as well. Meanwhile, the technical picture has improved for the trade-weighted euro, as recent strength has managed to highlight a higher base within the last 6-month trend up. This continues to hint of further strength for the euro, which puts the EUR/USD in position to the recent highs near 1.21 once 1.1950/60 is fully cleared to the topside.

Leave A Comment