There’s quite clearly a diversity of opinion here on Slope, as SB’s post pointing to bullish times ahead is somewhat different than my all-hell-is-about-to-break-loose view. Time will tell. On the latter, I offer these ETF charts…DIA

First is the Dow 30 DIA which, if nothing else, is quite a distance from its main supporting trendline. Last week saw some weakness, and this may be nothing more than a downward “blip” on the steady ascent that’s been in place for many months. I am positioned instead for a weakening toward support.

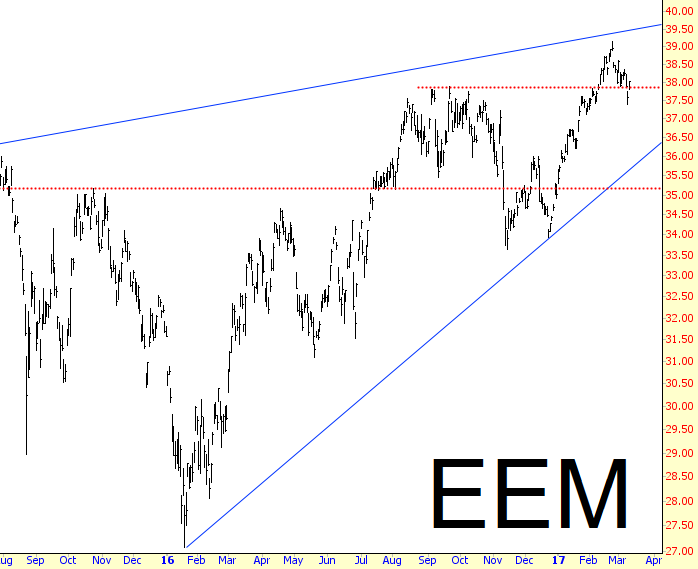

Somewhat more clear is the emerging markets chart, EEM, which has already produced a failed bullish breakout.

My favorite index of late has been the small caps – that is, the Russell 2000 as represented by IWM. It had broken above its descending channel, but weakness overtook it and it is once again drifting relatively sideways within the confines of the same channel.

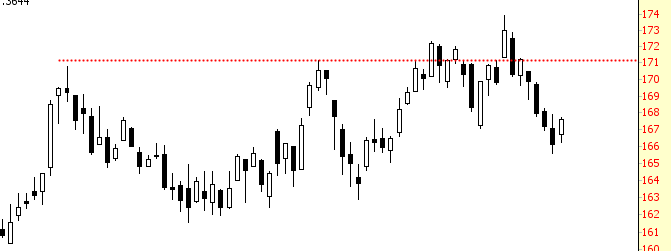

The Dow Transports IYT, similar to the emerging markets shown above, has also failed its bullish breakout, and it has sunk far deeper into malaise than most other indexes.

Crude oil, by way of USO, had a terrific break last week, and although I’m not expecting anything like the calamity we saw during the prior break (see arrows), I’m confident about my bearish energy positions.

Lastly, the financial stocks, XLF, took eight years to crawl back up to the same nonsensical high it had reached in 2007. Double-top, anyone?

Leave A Comment