Here is how I see the precious metals situation. It’s one or the other of…

It. Is. A. Bounce… until it proves otherwise by seeing gold rise against CRB, SPX, ACWX and while we’re at it, global currencies.

So for now it’s just a bounce, and the [daily] Silver/Gold ratio did make a positive hint of Friday.

As is often the case, the sector will rally with cyclical assets if the rally is anti-USD and/or inflationary. This is not long-term positive signaling for the gold miners, however. Quite the contrary. So if you’re in them, enjoy the bounce – insofar as it continues – but be prepared to sell (if you are not positioning L/T) because if the other stuff liquidates the gold miners likely will as well, perhaps before hand and perhaps even more intensely.

Here is the view vs. stock markets; also not pleasing if you are a gold bug wanting to buy [gold stocks and gold related investments; it’s always a good time for physical gold as a value anchor & insurance] for the right reasons. Now, this pretty cyclical picture [risk ‘on’] could come apart tomorrow and then we’d pound a table, fundamentally.

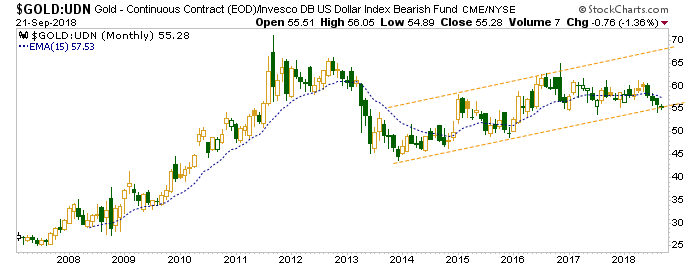

Gold weekly is still stuck in the resistance zone during the inflationary cyclical bounce. Gold’s lack of participation is actually not such a bad thing when you think about it.

Silver however, would need to get going and lead during an inflationary play.

HUI got within 4 points of initial resistance at 150.

The daily chart shows that resistance area to coincide with the SMA 50. Folks, if it bounces again and funda do not change, I’d have some caution there.

I am going to skip the cavalcade of gold stock charts because well, on balance they are lousy (with some exceptions). I cannot in good conscience put too much into this sector at a time like this, when it’s bouncing and the fundamentals are not engaged. We looked for a bounce and finally it came. Unfortunately, it came as part of an anti-USD global asset bounce. It’s not legit.

Leave A Comment