The original article as written by Matthew Tucker (blackrockblog.com) is presented here by the editorial team of munKNEE.com in a slightly edited ([ ]) and/or abridged (…) format to provide a fast and easy read.

It’s an investor’s rule of thumb and a rule of life – don’t put all of your eggs in one basket. When it comes to your portfolio, it’s best to spread out your holdings in markets to avoid being hit by the fall in any one investment. This is called “diversification”. It works when building a portfolio of individual stocks or bonds, and works equally well when building your overall investment portfolio.

Many investors have steered clear of the Barclays Aggregate (Agg) bond index since 2013, believing its higher duration, or interest rate risk, left them exposed to large losses in the event that interest rates skyrocketed. Well, the Federal Reserve raised its key interest rate in December from a range of 0% to 0.25% to a range of 0.25% to 0.5% but, in an unexpected twist, most interest rates have actually fallen so far this year.As a result, according to Bloomberg data, the Agg is up 2.05% through February 5. That’s right. It’s up, and while it’s not enough to save you from falling equity markets, it can help cushion the blow.

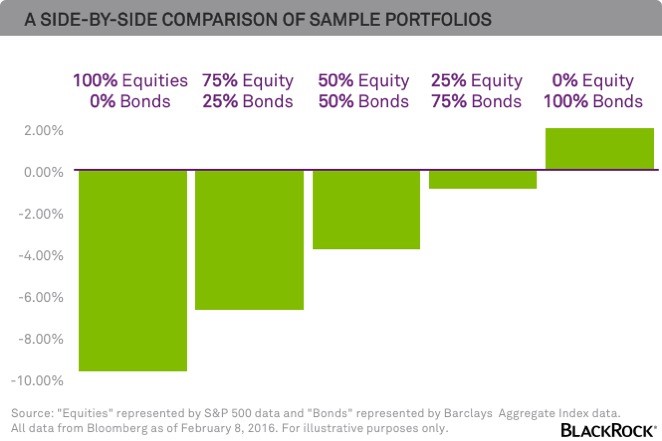

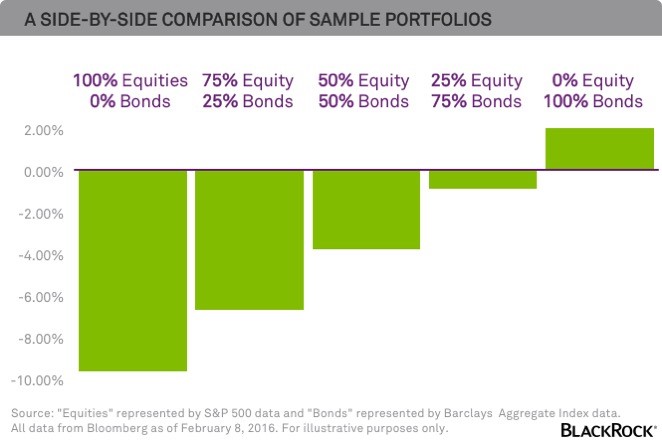

Let’s look at a side-by-side comparison. To illustrate our point, we looked at the S&P 500 to represent equity performance and the AGG to represent bond market performance, both YTD through February 8, 2016. The chart below shows the return numbers for a portfolio made up entirely of stocks, a portfolio made entirely of bonds and portfolios with blends of both stocks and bonds:

As you can see, the diversified portfolios have done much better in the equity market downturn, cushioning some of the stock market losses.

Now some of you may be looking at the markets and saying “Sure Matt, I get that this works when equities fall but most people believe that equities will have higher returns than bonds over the long run so I am going to stay in equities and just ride the market out”.I hear comments like this a lot, especially from younger investors.In theory this approach could work, but there are two big issues you may want to consider:

Leave A Comment