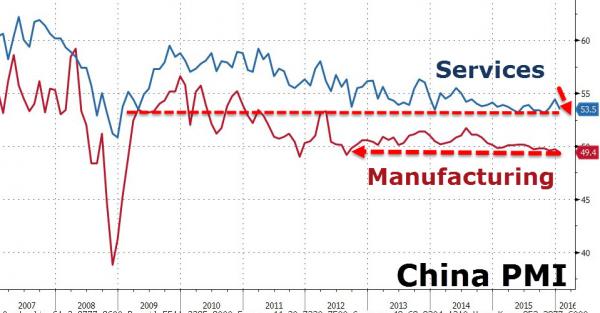

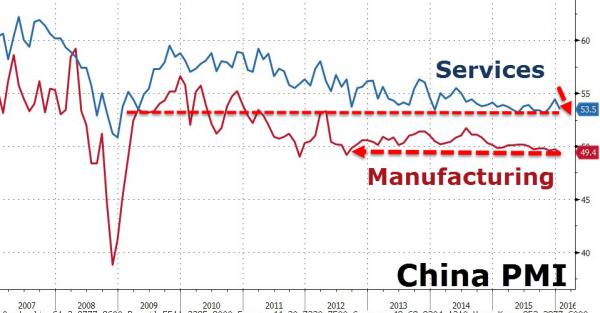

It didn’t take much to fizzle Friday’s Japan NIRP-driven euphoria, when first ugly Chinese manufacturing (and service) PMI data reminded the world just what the bull in the, well, China shop is…

… leading to a 1.8% drop on the first day of February after Chinese stocks slid 23% in January with the nation’s manufacturing sector faces strong galewind challenges as the government plans to reduce excess industrial capacity and unleash troubling mass unemployment, while a weakening currency is spurring capital outflows.

And then it was about oil once again, when Goldman itself – which recently has been quietly changing its tone on oil to bullish – said not to expect any crude production cuts in the near future, to wit: “The past week featured headlines suggesting that OPEC producers and Russia would meet in February to discuss a potential coordinated cut in production. Despite the sharp bounce in oil prices that these headlines generated, we do not expect such a cut will occur unless global growth weakens sharply from current levels, which is not our economists’ forecast.”

Throw in some very cautious words from the sellside about what the BOJ’s move actually means and Friday’s month-end window dressing 2.5% surge is now just a distant memory.

As a result European stocks declined after the Chinese PMI fell to a three-year low in January. Nokia tumbles, dragging technology shares to biggest decline. Euro rose for an 8th day against the yen amid speculation the European Central Bank won’t be as aggressive as the Bank of Japan in boosting monetary stimulus.

“Investors are getting conflicting signals about global growth, Daniel Murray, London-based head of research at EFG Asset Management, told Bloomberg. “It’s all very confusing and it’s making people nervous. Even the smallest macro event or data point can tip sentiment either way.”

Asian stocks remained buoyed by the BOJ momentum rose for a 4th day as shares in Tokyo extended Friday’s rally after the Bank of Japan stepped up its monetary stimulus. Chinese shares extended their steepest monthly selloff since the global financial crisis after an official manufacturing gauge missed estimates.

“The BOJ’s action on Friday helped — it’s a situation where you get short-term relief when central banks make supportive announcements or ease policy,” Steven Milch, chief economist at Suncorp Wealth Management in Sydney, said by phone. “I’m not sure central bank actions are a panacea, but they do help in relation to investor sentiment. Uncertainty is clearly very high and it is possible that some markets have overshot on the downside. There’s a possibility that risk aversion and volatility diminish as we go forward.”

Here is where we stood as of this writing:

Looking at global markets, we start in Asia where equities traded mixed with the Nikkei 225 (+2.0%) the notable outperformer as participants continued to digest last week’s BoJ decision while the ASX 200 (+0.80%) was pushed higher with strength in health care names. Shanghai Comp. (-1.8%) underperformed amid rising risks that the nation faces a structural downturn following soft Official Mfg. PMI at its lowest since Aug’12, offsetting better than expected Caixin PMI data. JGBs were bid throughout the session, with yields plummeting to record lows in the 2-yr and 10-yr following the Friday’s stimulus move by the BoJ, as such the yield curve has notably steepened.

Asian Top News

European equities trade mostly in the red following sentiment brought about by the release of soft Chinese Official manufacturing PMI data, which printed at its lowest since Aug’12 and showed the 6th straight month of contraction. Furthermore, the poor official figures offset better than expected Caixin PMI data, which still came in below 50, thus demonstrating contraction, highlighting the weak outlook for the global economy.

The IT sector is the laggard in the Eurostoxx50 (-0.7%), following an EU proposal for tough new data protection laws, which German giant SAP say could put companies at a disadvantage to their US counterparts. Dax underperforms in terms of indices, with ThyssenKrupp weighing on the German bourse, following negative sentiment in the metals complex.

Leave A Comment