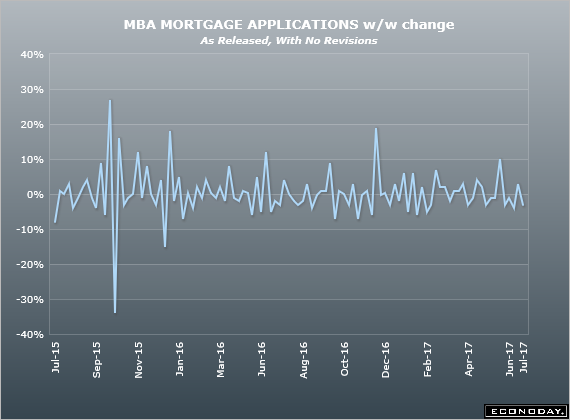

We discuss the poor performance of Mortgage Applications (Bad Yearly Comps – remember where the 30-Year Bond was after the Brexit Vote) some good and bad news for Houston Real Estate, and the return of the securitization market for subprime residential mortgages in this market video.

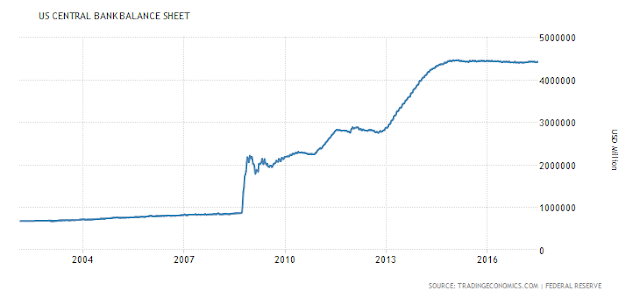

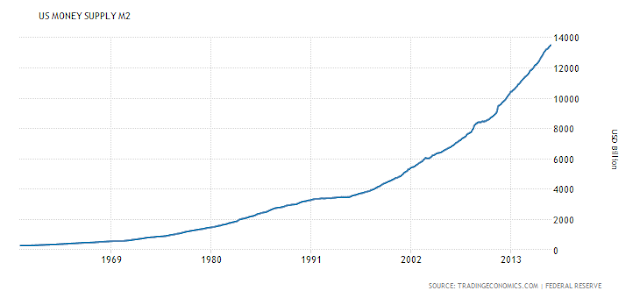

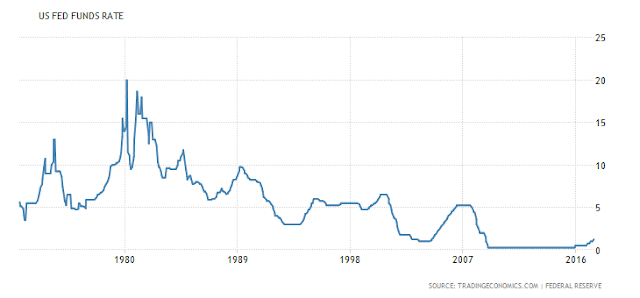

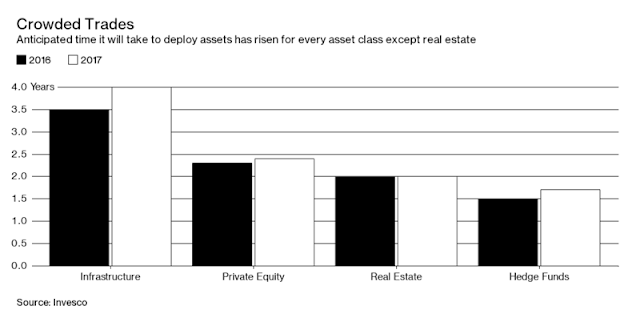

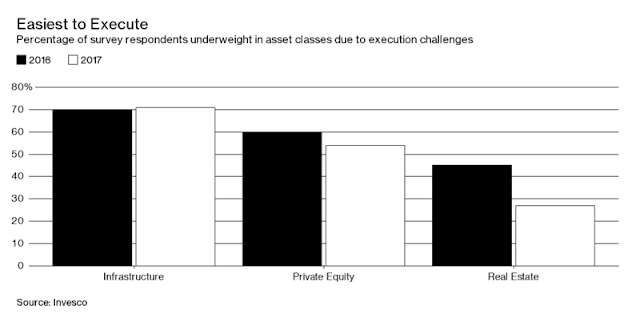

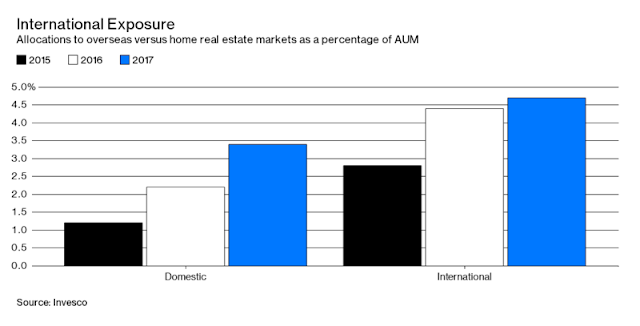

There is too much capital sloshing around the world right now chasing too few good investment assets. The central banks thought we were in a “new normal” environment for interest rate policy, that they could keep these low rates forever, and print as much money as they liked with no unintended consequences. Well we are starting to experience asset price inflation in multiple categories from housing and real estate markets, to stocks and bond markets, all the way to art and alternative investment vehicles like private equity and large infrastructure investments. Inflation is muted due to technological innovation and a lack of fiscal policy cohesion and structural demographics but it will come sure as every other cycle event. Inflation will be the next shoe to drop and when it comes it will be unstoppable without swinging heavily to the upside with an aggressive and overly brutish high interest rate structure by central banks. There is never a new normal just the ebb and flow of the normal economic cycles of central banks` schizophrenic insanity regarding micro managing interest rates and monetary conditions of cheap and expensive credit.

Video Length – 00:24:26

Leave A Comment