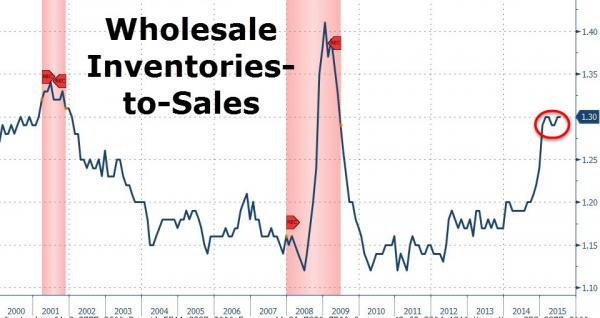

The Wholesale Inventories-to-Sales ratio has now been stuck deep in recession territory since January as the malinvestment boom-driven deflation-beckoning dream of “if we build it they will come” inventory surges smashes into the ugly reality of peak-debt-based lack of consumption worldwide. Inventories dropped 0.1% in July (notably lower than the 0.3% rise expected and the biggest drop since May 2013), but worse still Wholesale Sales tumbled 0.3% (missing expectations of a 0.1% rise). So inventories dropped (bad for Q3 GDP) and sales dropped more (even worse) leaving July’s 1.30x inventories-to-sales ratio remains a flashing red beacon of over-capacity and looming production cuts (especially in Automakers).

Recession looms…

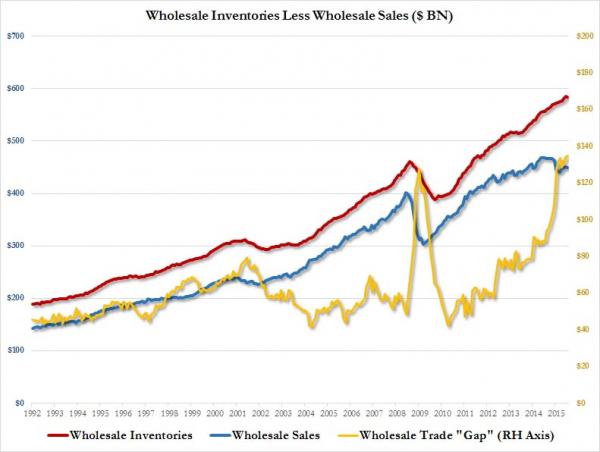

The absolute dollar size of the gap between Inventories and Sales has never been bigger and is the biggest flashing red light that an economic recession is now inevitable as part of the massive de-stocking, likely at deflationary dumping prices, that has to take place.

Led by Automakers over-building:

And sending ominous signals for Q3 GDP…

In short, the Fed’s timing for a rate hike couldn’t be better.

Leave A Comment