Photo Credit: Day Donaldson

Comments

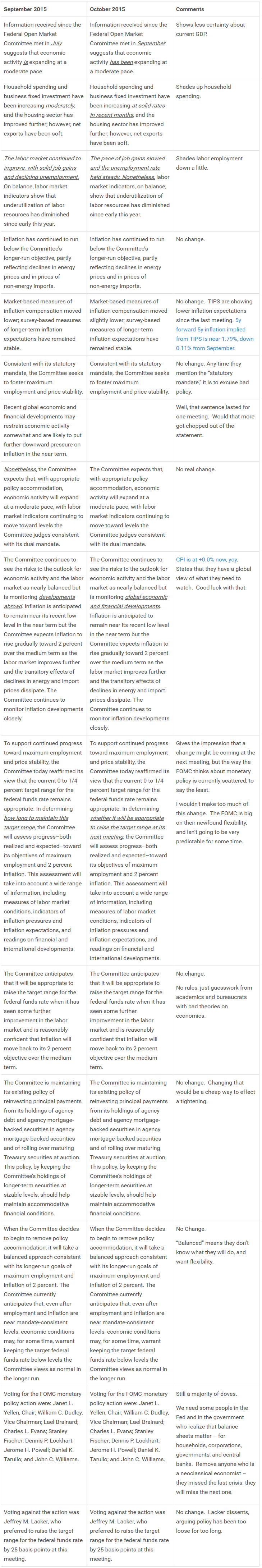

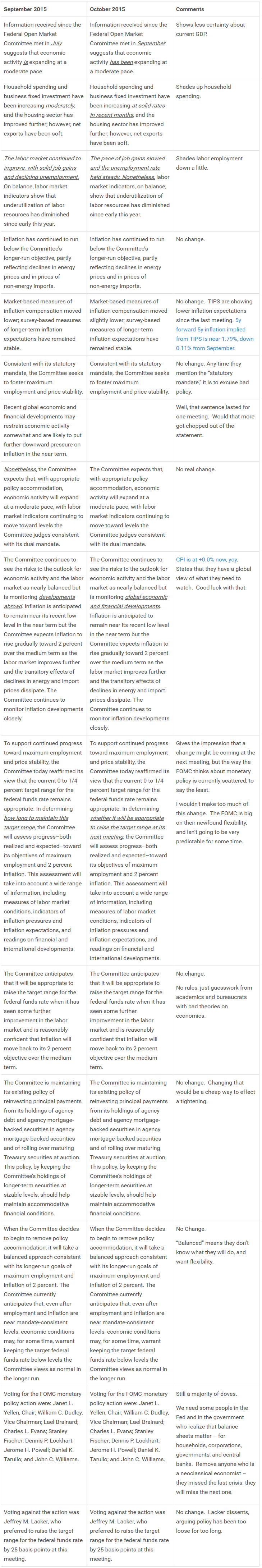

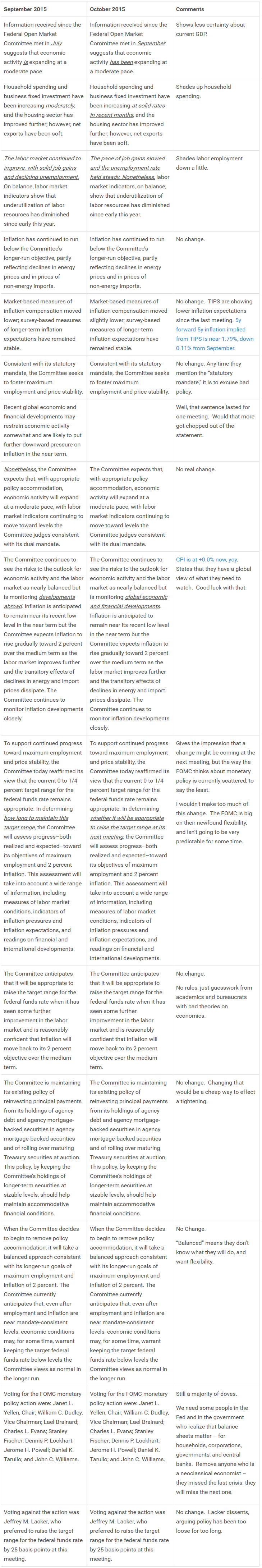

This FOMC statement was yet another great big nothing. Only notable changes were shading household spending up, and employment and GDP down.

Don’t expect tightening in December. People should conclude that the FOMC has no idea of when the FOMC will tighten policy, if ever. The FOMC says that any future change to policy is contingent on almost everything.

On the new phrase, “whether it will be appropriate to raise the target range at its next meeting,” I would not make much of it. It gives the impression that a change might be coming at the next meeting, but the way the FOMC thinks about monetary policy is currently scattered, to say the least. I wouldn’t make too much of this change. The FOMC is big on their newfound flexibility, and isn’t going to be very predictable for some time.

Despite lower unemployment levels, labor market conditions are still pretty punk. Much of the unemployment rate improvement comes more from discouraged workers, and part-time workers. Wage growth is weak also.

Equities fall and bonds rise. Commodity prices fall and the dollar rises. This is a sign that the markets anticipate more economic weakness.

The FOMC says that any future change to policy is contingent on almost everything.

Don’t know they keep an optimistic view of GDP growth, especially amid falling monetary velocity.

The key variables on Fed Policy are capacity utilization, labor market indicators, inflation trends, and inflation expectations. As a result, the FOMC ain’t moving rates up, absent improvement in labor market indicators, much higher inflation, or a US Dollar crisis.

We have a congress of doves for 2015 on the FOMC. Things will continue to be boring as far as dissents go. We need some people in the Fed and in the government who realize that balance sheets matter – for households, corporations, governments, and central banks. Remove anyone who is a neoclassical economist – they missed the last crisis; they will miss the next one.

Leave A Comment