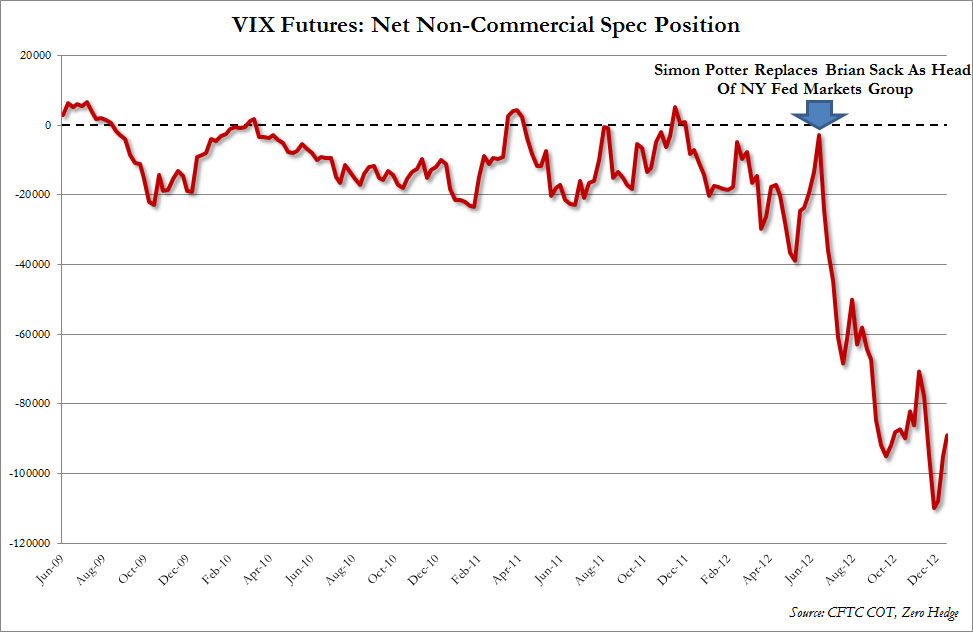

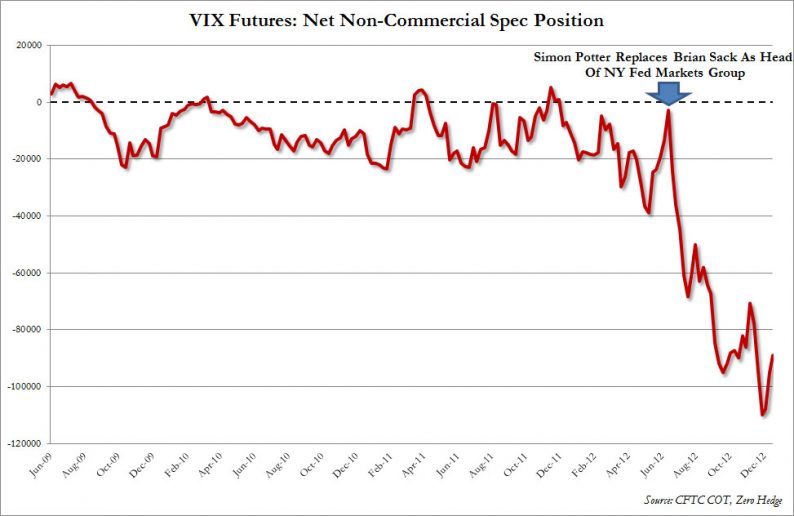

Back in late 2012, when the former chief of the NY Fed’s markets group, aka the head of the PPT, Brian Sack was replaced with the current head of the NY Fed’s trading desk, Simon Potter, we observed something curious: there was a dramatic, and record, surge in non-commercial bearish VIX bets the moment Potter took over, which courtesy of the reflexivity relationship between the VIX and the underlying market (since exposed everywhere, read: “Conspiracy “Fact” – VIX Manipulation Runs The Entire Market”), helped push stocks higher.

Click on picture to enlarge

Ever since then, the infamous VIX slam in the last hour of trading, or during other opportune intervals in the trading day, has served as a valuable and efficient means to halt any selloff momentum and to reallign the market with its centrally-planning mandated path: higher.

In fact, it has gotten so that trading of VIX (and its close cousin, the USDJPY carry trade) has replaced trading the S&P courtesy of the far greater embedded leverage available to those two asset classes.

Fast forward to the recent surge in market volatility, when courtesy of JPM we find something curious: it is no longer the Fed, nor its capital markets proxy, Citadel, nor even the banks or hedge funds that are the primary sellers of volatility. It is retail investors themselves!

Sure, institutionals did rush to sell vol, mostly in the form of surge in the VIX put-to-call ratio, but the jump was somewhat timid by historical standards. JPM explains:

The sharp rise in equity volatility with the VIX spiking to levels last seen in August 2011 is raising questions about volatility flows. One flow that reveals the intentions of institutional investors is related to VIX options. The ratio of the open interest of VIX put options over the open interest of VIX call options has been rising since August 17th, suggesting that institutional investors are increasingly positioned for a decline in vol similar to what they did during the October 2014 volatility episode (Figure 6). But what is also evident from Figure 6 is that the recent rise of the ratio of the open interest of VIX put options over the open interest of VIX call options rose by a lot less in the recent correction vs. the rise seen during August 2011. At the time, in August 2011, that ratio had tripled to 1.2x vs. 0.6x currently. One explanation for this discrepancy is that the vol of vol (VVIX) has spiked by so much in the most recent correction, to 170% vs. a peak of 130% in August 2011, that it reduced on the margin the incentive by institutional investors to buy VIX puts.

Leave A Comment