Retail sales jumped 1.3% in April following yesterday’s miserable stew of retail sales reports.

Last evening ZeroHedge sarcastically tweeted

After retailers reported abysmal earnings, it is only logical that tomorrow’s retail sales report will be a big beat

— zerohedge (@zerohedge) May 13, 2016

He was correct.

For the second irony, the report was so good, that US treasuries rallied.

The Bloomberg Econoday consensus estimate for retail sales was 0.9%. Sales jumped 1.3%.

Highlights

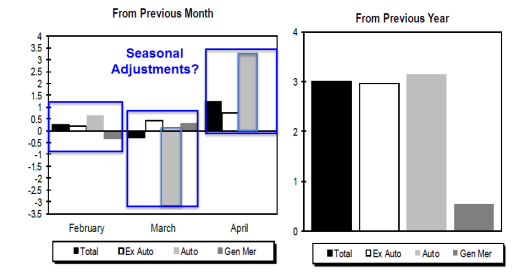

The consumer snapped back to life in April, driving retail sales 1.3 percent higher to beat Econoday’s consensus by 4 tenths and the high estimate by 1 tenth. Gains are spread throughout most of the report.

Autos are the key component, up a sharp 3.2 percent to reverse the prior month’s decline. Excluding autos, retail sales rose 0.8 percent.

Sales at gasoline stations, boosted by higher prices, also contributed strongly, up 2.2 percent in the month. But even excluding both autos and gasoline, sales still rose 0.6 percent for the third straight gain, two of which are very strong.

Apparel was a big contributor in April along with nonstore retailers and with restaurants also showing a gain. The only component in contraction was building materials & garden equipment which hints at a little cooling for what has been very solid residential investment.

Year-on-year rates all improved though total sales remain very soft at 3.0 percent. Auto sales, pulled down by tough comparisons with very strong sales this time last year, are up only 3.1 percent on the year. But other components show strength with the ex-auto ex-gas rate at a healthy 4.4 percent for a 5 tenths gain in the month.

Today’s report points to a solid start for the second quarter and gives some life to the possibility of a June FOMC rate hike.

Retail Sales Charts

Charts from Census Department Advance Monthly Sales.

Some of these numbers look peculiar so let’s dive in further.

Leave A Comment