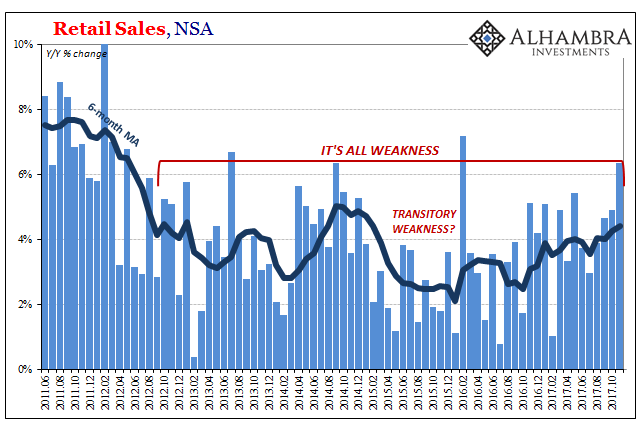

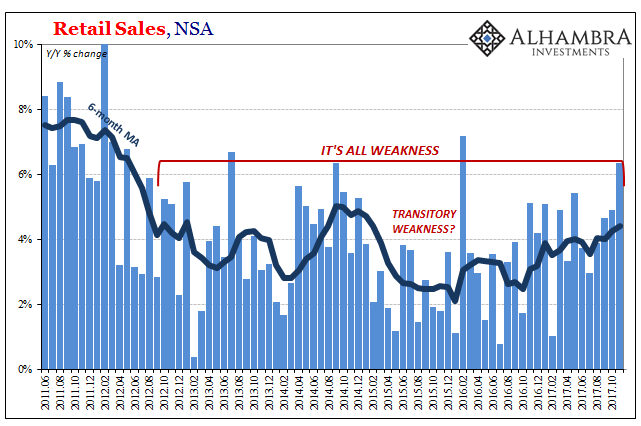

Retail sales had a good month of November, or at least what counts as decent over the last five and a half years. Total retail sales (unadjusted) rose 6.35% last month, up from 4.9% (revised higher) in October. It was the highest rate of growth since the 29-day month of February 2016. For retailers, what matters is that it comes at the start of the Christmas shopping season.

The question is why, or more so why now? Retail sales had been lagging, seriously weak throughout much of the middle parts of 2017. After rising at an almost normal clip in the back half of 2016, consumer spending materially softened starting in February. From that month until August, retail sales were up just 2.8% (seasonally-adjusted), or a 3.3% annual rate of expansion closer to recession levels than accelerating consumer activity.

In September, however, retail sales surged and have kept going for now three months in a row to November. In those three months, trade is up 3.3% (seasonally-adjusted) which works out to a ridiculous 14.3% annual rate. Either the economy suddenly flipped into 1984, or Harvey and Irma are leaving their first real imprint.

If the latter is the case, which seems quite likely, then we should expect flagging retail sales probably to start next year (after the holidays when the credit card bills come due, and then in 2018 insurance premiums in those storm-ravaged areas are “adjusted”). There is recent precedence for this kind of pause after a storm surge of spending.

In early 2014, winter storms and the historic cold of that season’s Polar Vortex seriously undercut consumer activity to begin the wrong way what was supposed to be a fabulous economic year kicking off the long-awaited full recovery. Retail sales actually declined month-over-month in January 2014 (which suggested what was going on was more than the weather) and then jumped for three months afterward. In those three months, overall retail sales were up 3.6%, or a likewise ridiculous 14.9% annual rate.

Leave A Comment