Written by Jean Boivin

The structural slowdown in global economic growth and dramatic drop in bond yields represent a paradigm shift that is forcing a rethink of portfolio allocations.

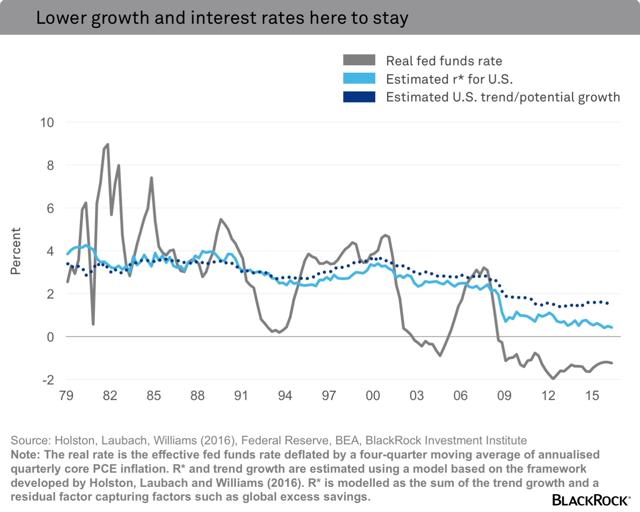

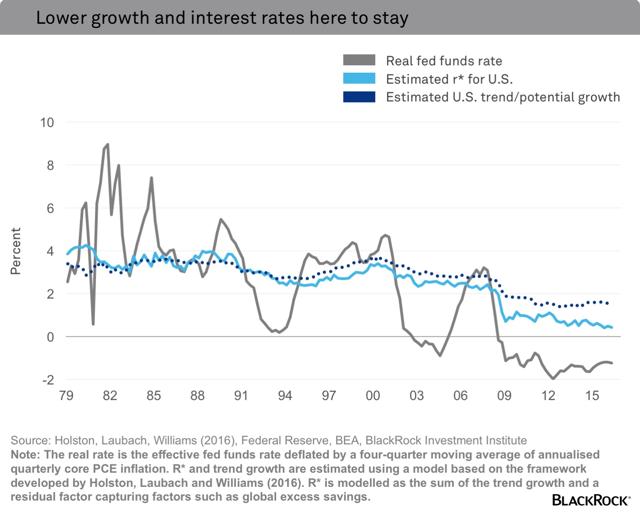

Aging societies, weaker business capital investment, and slowing productivity growth have led to a persistent decline in economic growth. As a result, what is now considered a neutral policy rate for a central bank – one that neither stimulates nor restrains growth – has experienced a likely medium-term decline in the United States and other major economies.

Lower neutral rates have meant that central banks need to cut interest rates much lower, even negative, to be able to stimulate economic growth. Central banks in Japan and the euro zone have already done that.

Low neutral rates and large central bank ownership of government bonds are why we see long-term bond yields staying low on a five- to 10-year horizon.

This environment of low growth and low rates has three important portfolio allocation implications:

1. We believe investors are being fairly compensated to take risk in the low-return landscape

Investors should not expect bond yields to revert to historical averages, notwithstanding likely short-term swings. This view shapes our muted outlook for returns.

Low risk-free rates – the fundamental basis for gauging asset valuations – represent an under-appreciated sea change in assessing future returns, in our view. Prospective returns on equities and bonds have fallen across the board after the global financial crisis but this masks the reality that equities – and by extension, other risk assets – still look attractive taking into account that bond yields are likely to stay historically low.

It’s easy to assume that low returns imply little compensation for risk [but] we do not think this is the case. In fact, when looking at the earnings yield relative to real bond yields – the equity risk premium (ERP) – investors are still being well compensated for risk in many corners, we believe.

Leave A Comment