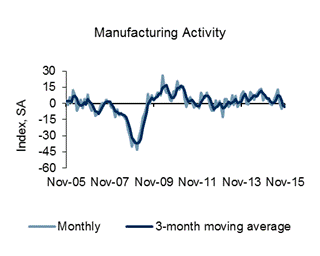

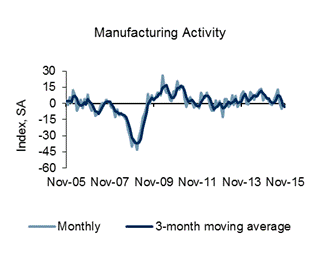

Of the four regional Federal Reserve surveys released to date, two are in contraction and the rest are weakly in expansion.

The market expected values (from Bloomberg) from 0 to +4 (consensus +1) with the actual survey value at -0.3 [note that values above zero represent expansion].

Fifth District manufacturing activity slowed in November, according to the most recent survey by the Federal Reserve Bank of Richmond. Shipments remained sluggish and new orders declined. Hiring in the sector changed little compared to the previous month, while the average workweek shortened and wages rose mildly. Raw materials prices rose at a somewhat faster pace, while prices of finished goods increased modestly in November.

Manufacturers’ expectations were less optimistic in November compared to October. However, they still looked for an improvement in business conditions during the next six months. Compared to October’s outlook, producers expected slower growth in shipments and in the volume of new orders in the six months ahead. Compared to current conditions, firms anticipated faster growth in backlogs and capacity utilization during the next six months, and. expectations for vendor lead times were expected to change little in the next six months.

Survey participants looked for moderate growth in wages and a pickup in the average workweek during the next six months. Hiring expectations remained solid in November, although the outlook was less robust than a month earlier. Firms anticipated faster growth in prices paid and prices received.

Current Activity

Manufacturing activity slowed this month, with the composite index softening to a reading of ?3, following last month’s reading of ?1. The index for shipments remained negative, ending at a reading of ?2, while the index for new orders fell six points to ?6. In addition, the index for employment flattened to a reading of 0 this month.

Vendor lead time changed little compared to the previous month; the index added only one point to end at ?1. Additionally, capacity utilization leveled off this month, with that gauge ending at 0. Backlogs of new orders weakened this month. The indicator lost nine points, finishing at ?16. Finished goods inventories continued to grow solidly, although that index fell below last month’s reading. The index slipped five points to end at 20. Raw materials inventories increased at a faster rate this month, with the index ending at 29, three points above last month’s reading.

Leave A Comment