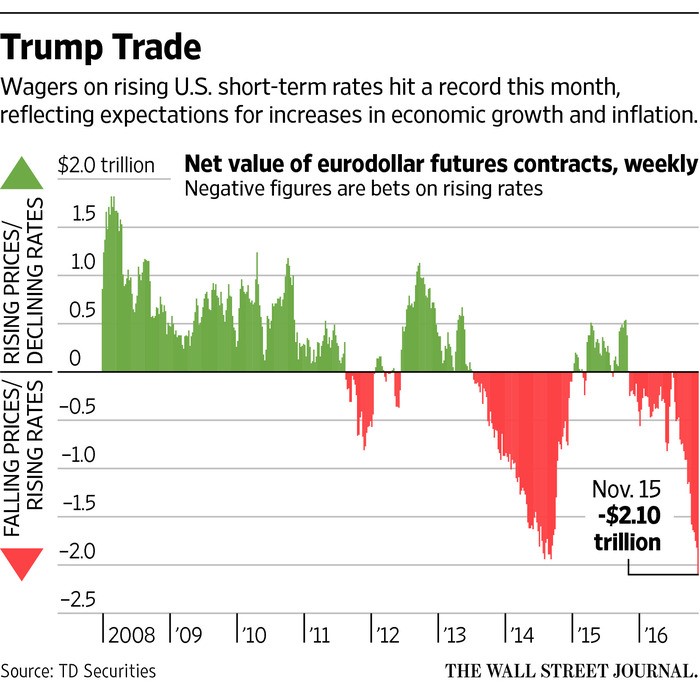

We at Smead Capital Management are in the camp of long-duration investors who believe we’ve entered an extended period of intermittent interest rate increases, a reversal from the 35-year era of intermittent declining rates we have experienced since 1981. The chart below shows that speculators have placed very heavy bets on rising interest rates in November.1 The placement of these heavy bets indicates that we could be close to the first temporary peak in the 10-year Treasury bond moving from the historically low rates around 1.5%. It looks to us like the first inning of a nine-inning game; the last game of this kind lasted 30 years.

We have also argued that the demographics of the U.S. dictate a stronger economy. We believe the economy will be led by a baby boom among 30 to 45-year old women and unusual spreads between housing affordability and rising rents. We think it is possible to create a tsunami of buyers nationwide and spur a housing boom. What will happen when the demand for houses and the nesting urge run into higher interest rates?

First, you have to look at history. The last housing boom was nutty in the early 2000s, because it was based on owning more than one home or owning a home the buyer couldn’t afford. The last boom propelled by actual household formation was in the mid-1970s. Baby boomers were getting married, having kids and defending themselves against rising inflation by purchasing a house. Of the homes lived in today in the U.S., our research shows that one out of ten were built between 1975 and 1980. As you look at these charts, remember that there are around 145 million more people living in the U.S. today than in 1960.2

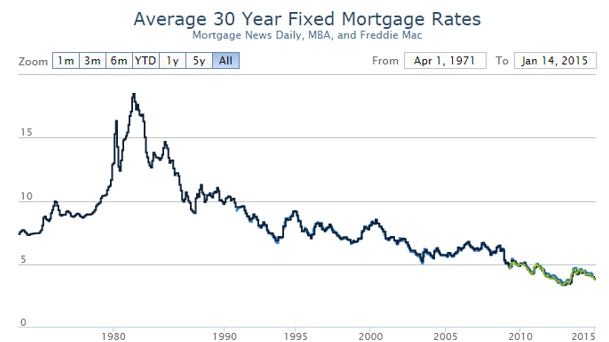

Furthermore, the last housing boom driven by household formation occurred at progressively higher mortgage interest rates. See the chart below:3

Therefore, if you want to buy a house to satisfy maternal and paternal instincts, it appears from a historical standpoint that interest rates and low levels of affordability don’t matter!

Leave A Comment