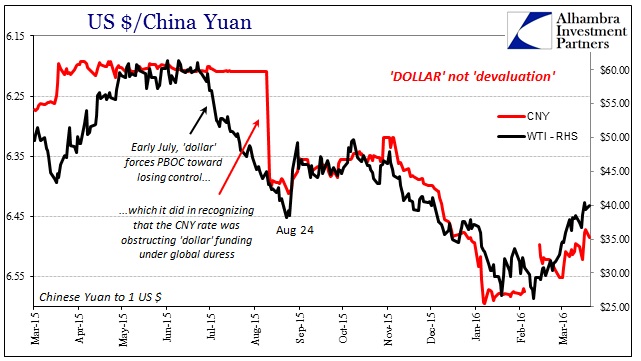

Oil prices remain ebullient, relatively, compared to the dismal start to the year. Everything else, it seems, is driven by that background which means “dollar.” In that respect, we look to China or at least the Asian version of the “dollar” for guidance on triangulating funding conditions and future potential positioning. The CNY exchange is still within the post-Golden Week window which is why oil prices (and everything else) are floating unanchored to continuous deterioration in fundamentals, oil as well as global economy.

There are some places in the “dollar” system where it seems fundamentals are still primary. I wrote on Friday about the record negative spread in cross currency basis swaps related to yen, which I believe is traced to Japan’s exposure to China as a “dollar” conduit (funded at the start by local yen liabilities, or what used to be called “hub and spoke” wholesale). A cross currency basis swap isn’t supposed to have any effect on the currency exchange rate since the swap itself is neutral on both ends – there is an upfront, agreed upon exchange price for the initial swap and then the same at maturity that removes exchange volatility. However, given the extreme imbalance in the basis (payment exchanges for “borrowing” each other’s currency) it must be having an exchange impact as at least an indication of wholesale “dollar shortage” if not more directly via the basis swap imbalance itself.

To that point, the JPY exchange rate has been stuck since February 11(the very day that oil rebounded) in a conspicuously narrow range. In other words, it suggested that even if general liquidation pressure had abated the funding imbalance was never removed or alleviated. Liquidity is not necessarily liquidation, and the former can remain atrocious even when the latter is nowhere to be found.

I think that delivers us both parts of the Asian “dollar” equation, where CNY has suggested liquidity and JPY its reverberating counterpart.

Leave A Comment