Written by Russ Koesterich (BlackRockBlog.com)

When building portfolios, most investors tend to focus on the appeal of return over risk but…ideally, investors should also take into account the expected risk (normally expressed as the standard deviations of return) and the co-movement (correlation) of each asset.

For investors using what is known as a formal optimization process, the last two components are represented in what we call a “co-variance matrix.” Put simply, it’s a mathematical device for keeping track of multiple columns and rows of numbers. Stripped of the mathematical mysticism, the co-variance matrix drives much of the asset allocation process. While this always serves as a general rule, it is particularly true today given a potential shift in the economic environment. Here are two reasons why:

1. Risk is stable but not always stationary

Between risk and return, risk is the easier parameter to estimate. While risk does shift over time—technology stocks are less volatile than they were back in the late 1990s—most of the time the riskiness of an asset tends to move slowly. That said, risk is not totally static.

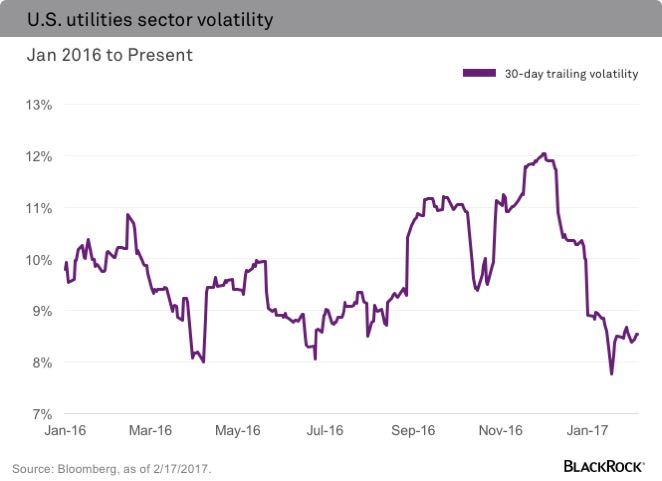

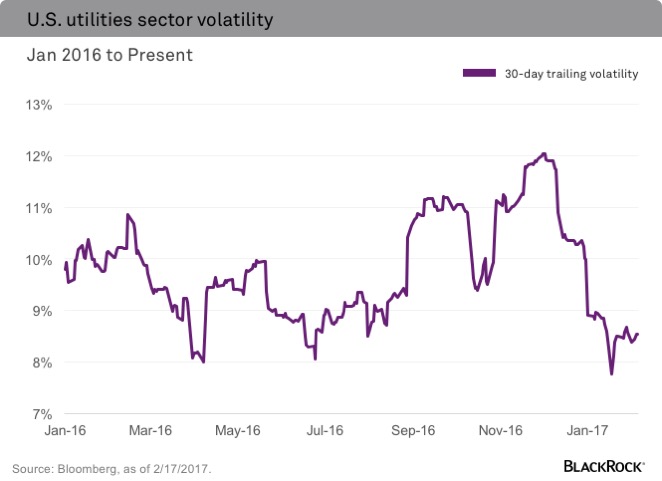

For example, last summer utility stocks lived up to their reputation as a low beta, low volatility sector. The 30-day trailing volatility for the S&P 500 Utilities Sector was between 8% and 9%, well below the broader market. However…as the market rallied in the fall, the sector’s volatility rose and, by December, the annualized volatility for large-cap U.S. utility companies had risen to approximately 12% (see the accompanying chart). What accounted for the rise? Most likely it was the near doubling of interest rates, which tend to disproportionately impact those sectors, such as utilities, owned primarily for their dividend yield.

2. Correlation matters

Even if you were able to forecast both return and risk with perfect precision, there would still be a missing element: correlation. Assume two assets, each with identical return and risk, the co-variance matrix would lead you to favor the asset class that is less correlated with the rest of the portfolio. People often underestimate this effect. Even for potentially low return assets, like gold, allocations can be high if you expect low or a negative correlation with other assets. The challenge is, as with risk, correlations shift…If correlations between stocks and bonds remain negative, as they have for most of the post-crisis period, bonds remain an effective hedge of equity risk. To the extent correlations rise as monetary conditions normalize, with all else being equal, that would suggest a more modest allocation to traditional fixed income, even if return expectations remain constant.

Leave A Comment