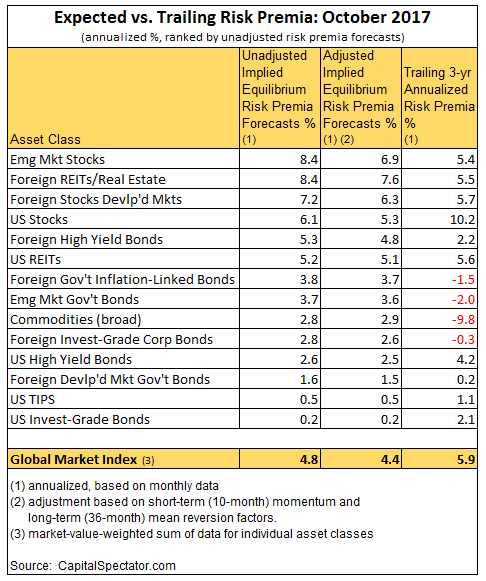

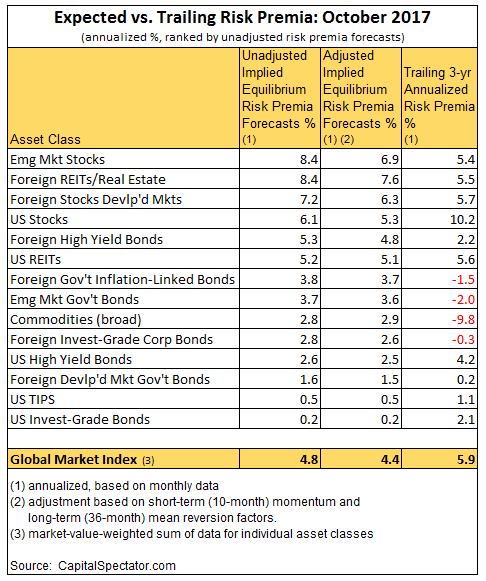

Risk Premia Forecasts: Major Asset Classes | 2 November 2017

The Global Market Index (GMI) — an unmanaged, market-value weighted portfolio comprised of the major asset classes — is expected to earn an annualized 4.8% risk premium (return over the “risk-free” rate) in the long run, based on analysis of data through Oct. 2017.

The forecasting engine is an equilibrium methodology (defined below) that uses risk (return volatility) and the relationship of assets (return correlation) to project performance. The input data reflects historical results for a particular set of markets for Dec. 1997 through Oct. 2017. Note that the same methodology applied to a longer or shorter time period will generate different results. Consider, too, that changing the mix of asset classes and/or the model will alter the forecast. As such, the numbers presented here can be considered a baseline for anticipating future market activity. Investors should carefully consider how or if to adjust the projections to align with their market assumptions, risk tolerance, and other factors.

As one example, adjusting for recent momentum and mean-reversion factors (defined below) trims GMI’s ex ante risk premium to an annualized 4.4%, modestly below the unadjusted 4.8% forecast.

For some historical context on what the market delivered in the past, here’s a chart of rolling three-year annualized risk premia for GMI, US stocks (Russell 3000), and US Bonds (Bloomberg Barclays Aggregate Bond Index) through last month. Note that GMI’s three-year risk premia has been trending higher in recent months.

Here’s a summary of the methodology and rationale for the estimates above. The basic idea is to reverse engineer expected return, based on risk assumptions. Rather than trying to predict return directly, this approach relies on the somewhat more reliable model of using risk metrics to estimate performance of asset classes. The process is relatively robust in the sense that forecasting risk is slightly easier than projecting return. With the necessary data in hand, we can calculate the implied risk premia with the following inputs:

Leave A Comment