Over the weekend, Sam Fleming with the Financial Times interviewed Boston Fed President Eric Rosengren about why the Fed is likely to tighten monetary policy sooner rather than later.

“The reason they should believe this time is different is that the economic conditions are changing over this period. If you go back to February there was a lot of financial market turbulence. The first quarter ended up being quite weak. Real GDP for the first quarter, at least from the preliminary report, was only half a per cent. You don’t need to tighten if the economy is weak and you are concerned about global market conditions potentially making it weaker.

If instead you are in an environment where you think labor markets are tightening, that GDP is improving and inflation is moving to 2 per cent that is an environment where more normalized interest rates would make sense.

Given that real GDP was only a half a per cent in the first quarter that is a relatively low threshold. If you look at how the data has actually been coming in I was a little surprised that there was not more of a market reaction to the very strong retail sales for April. If you look at the economic forecasters in the private sector most of them have raised their consumption forecasts for the second quarter to be in the range of 3 per cent to 3.5 per cent. When consumption is roughly two-thirds of GDP, a number that high for that major a component means that it is likely we will see growth around 2 per cent.”

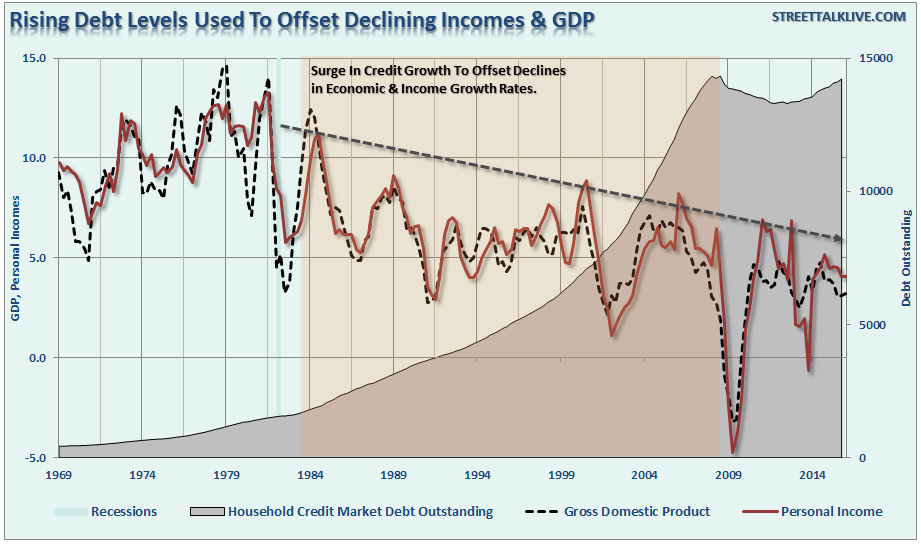

Here is the problem, the hope of higher personal consumption and stronger GDP has been the ever evolving “wish” of the Federal Reserve since the “financial crisis.” Of course, with each passing year, these “hopes” have turned to dust as consumers have struggled to make ends meet as wages have failed to grow, employment has been in primarily lower wage paying jobs.

The rise of the consumer society is a crucial point that continues to be missed in the ongoing arguments that try to explain the inability of the economy to achieve lift off. Let me explain.

Leave A Comment