With interest rates still at historic lows and the stock market soaring, income investors are hard pressed to find good places to put new capital to work.

As a result, high-yield stocks such as Royal Dutch Shell (RDS-A) often attract investors with the promise of mouthwatering yields.

But while there are excellent high-yield stocks out there, a very high yield can also be an important red flag that a company’s fundamentals have deteriorated to the point that the payout may no longer be safe.

Our Dividend Safety Scores can help separate the risky high yield stocks from the safer ones.

Let’s take a closer look at this integrated oil company for our Conservative Retirees dividend portfolio to see if Royal Dutch Shell represents a solid value investment or a value trap that should be avoided.

Business Overview

Founded in 1907 in the Netherlands, Royal Dutch Shell is one of the world’s largest publicly traded integrated oil companies with 13.2 billion barrels of reserves, 23 global refineries, 100 distribution terminals, and 770 supply points.

The company operates with three major segments: upstream (oil & gas production), downstream (refining, petrochemicals, and oil & gas marketing), and integrated gas (the company’s liquefied natural gas or LNG operations).

The class A shares are domiciled in the Netherlands, while class B shares (RDS.B) are domiciled in the U.K. Investors should choose Class B shares to avoid having any of their dividends withheld for tax purposes (the U.K. doesn’t withhold dividends on U.S. investments).

In Q4 of 2016, the company’s upstream operations produced an average of 3.9 million barrels per day of oil equivalent, a 28% year-over-year increase.

Meanwhile, the company’s fleet of global refineries has a daily capacity of 2.7 million barrels per day and 17.3 million tons per year of high margin petrochemicals.

As for the LNG operations, which are expected to be the main growth driver going forward, the company’s capacity is now up to 30.88 million tons per year, up 50% year over year.

As you can see, Shell’s upstream oil business continues to suffer from the worst oil crash in over 50 years.

Fortunately, however, its highly diversified business model still allows it to achieve substantial profits thanks to its LNG and refining/petrochemical businesses.

Source: Royal Dutch Shell Earnings Release

Business Analysis

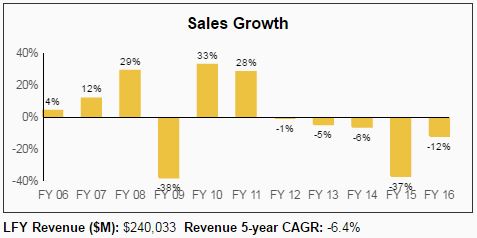

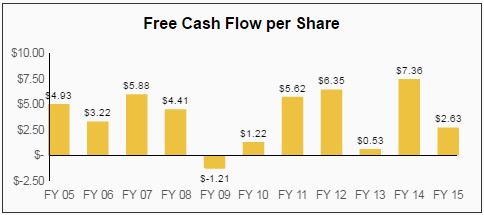

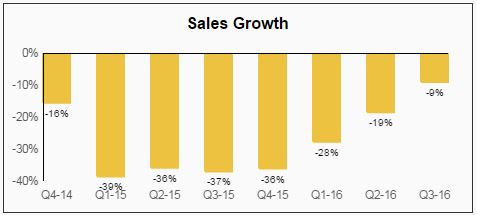

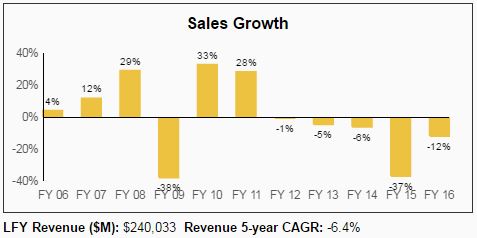

Like most oil companies Royal Dutch Shell’s sales, earnings, and cash flow are highly cyclical, coming in booms and busts based on energy prices.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

Source: Simply Safe Dividends

Following the bust in oil and gas prices in 2014, business conditions have been challenging, to say the least.

Sources: Royal Dutch Shell Earnings Release, Morningstar

Fortunately for shareholders, management has spent the last several years working hard to diversify its business, stabilize cash flow, and cut costs to the bone.

And thanks to the recent recovery in oil and gas prices, Shell has returned to profitability, despite a continued slide in revenue.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

Most of this has come from a major corporate restructuring, which includes several major changes.

First, the company slashed its capital expenditures, primarily by reducing what it spends on searching for and producing new, higher cost oil reserves. That process is ongoing, with Shell targeting 2017 capital expenditures of $25 billion, down 57% since 2013.

Leave A Comment