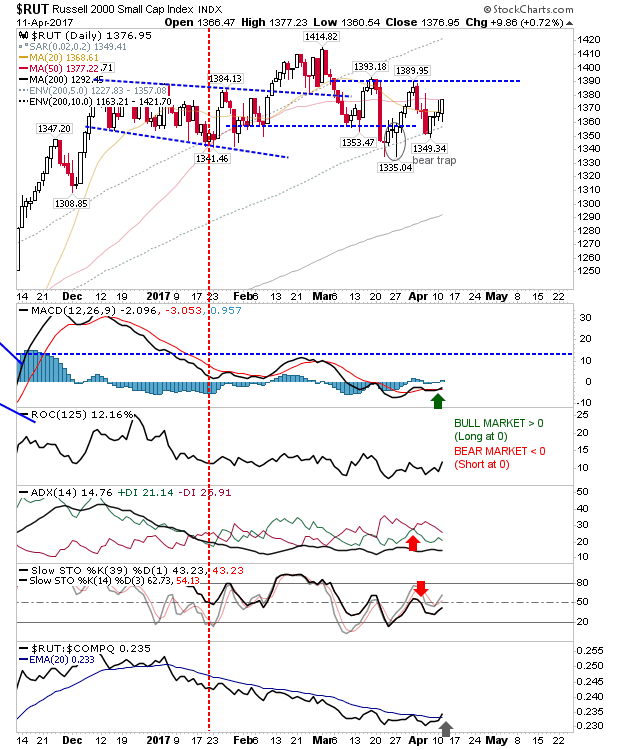

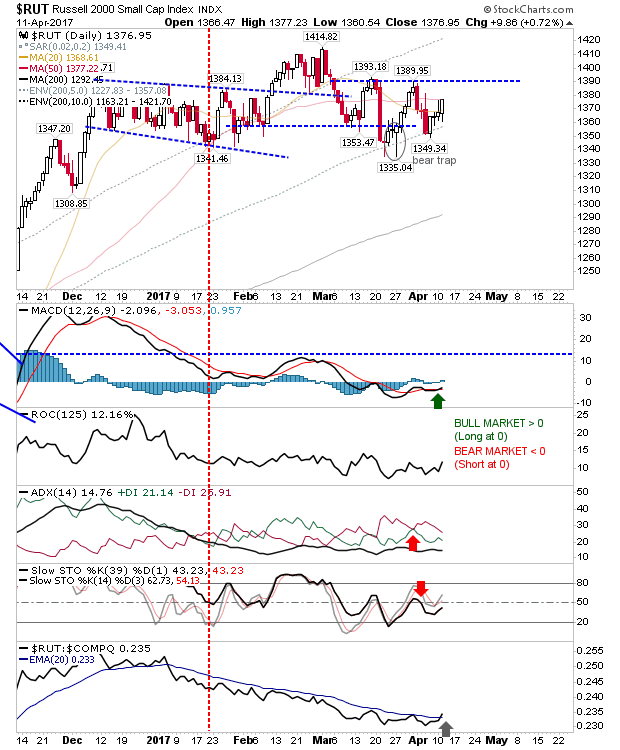

It was a good day for indices as early weakness gave way to sustained buying into the close. There was early morning weakness to set the tone but it didn’t last. The one index to rebuff this was the Russell 2000. After yesterday’s respectable finish the index went on to rally back to its 50-day MA. The gains in the Russell 2000 were enough to trigger a ‘buy’ in the relative performance against the Nasdaq and MACD trigger ‘buy’. Momentum buyers won’t join the fun until 1,393 is breached, so another 20 points of gains could be on the cards before supply becomes a problem.

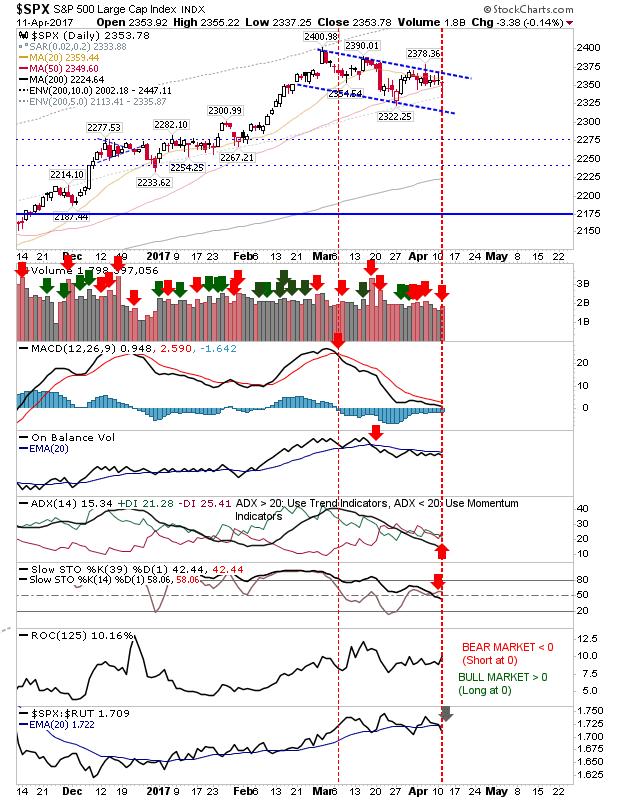

The S&P experienced a spike low as morning selling pushed the index well below its 50-day MA. However, it was able to recover to finish above the 50-day MA, but not before technicals turned net bearish. Can it break out of the 6-week channel consolidation?

The Nasdaq started the day near resistance, finished the day near the same resistance, but managed a picture perfect tag of its 50-day MA over the course of the morning. The stage is set for a challenge of 5,936 resistance, but it will need buyers to get there. Technicals suggest further gains are favoured, so it will be up to the market to deliver.

For tomorrow, look for today’s afternoon buying to continue into the morning. Should buyers come in to drive such an advance, then next will be to look for resistance breakouts. At that point, momentum players could become a factor and trigger actions of short covering. This trifecta of buying could deliver big gains.

Leave A Comment