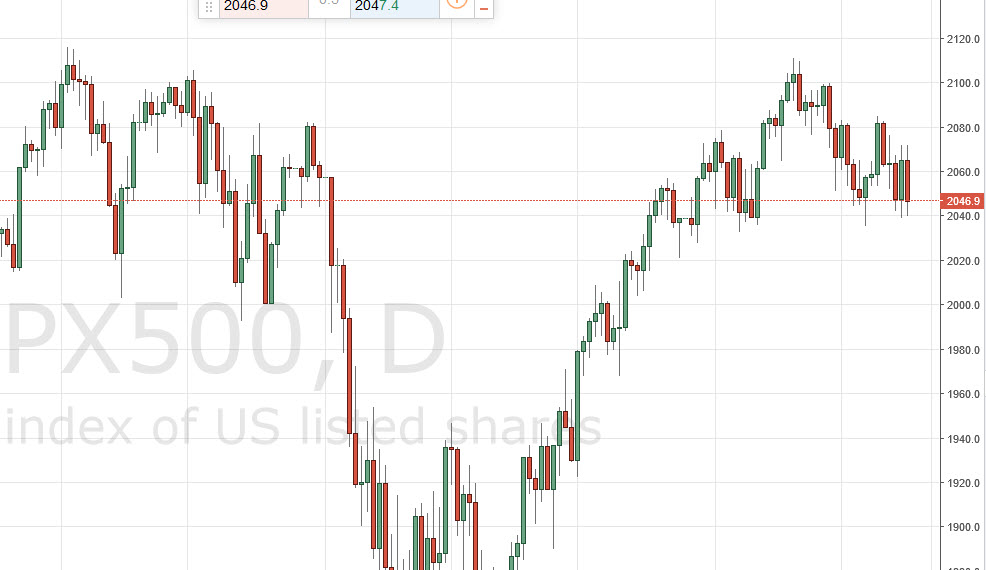

S&P 500

The S&P 500 fell during the day on Tuesday, as we continue to bounce around the 2050 region. We tested the 2040 handle for support again, and of course found it there but as you can see the market does not look ready to move in any one particular direction. Perhaps later today after we get the FOMC Meeting Minutes somebody will make a move, but until then I think that we are looking and short-term back and forth type of trading at this point. Any bounce off of the 2040 level will probably find resistance there 2070 so if you have the ability to trade short-term charts, you may do so in this particular market in my opinion.

NASDAQ 100

The NASDAQ 100 is doing much the same, as the 4325 region offers support. I think that eventually we will break above the 4400 level and continue higher, but we obviously need to build up a bit of momentum at this point in time. Even if we broke down, I think that once we get to the 4275 level, we will start to see a significant amount of support and therefore it might be difficult to short this market just due to the fact that there’s so much noise below. It’s not to say that we can go lower than that, it’s just that it isn’t going to be very easy to do so. With that being the case, I think that short-term back and forth trading is probably what we will be looking at, just as we see in the S&P 500.

Ultimately, I do think that we go higher but it is going to be a bit of a fight. I do not anticipate that the move will be easy either way, and as a result I feel that it’s only a matter of time before something has to be done in order to get a little bit of clarity. In the meantime, I just feel like we are waiting for something.

Leave A Comment